Amid a busy data calendar, the Federal Reserve took center stage this week and much of the drama took place behind the scenes. Heading into the much-anticipated policy meeting it was unclear who would participate, as the race to confirm a new governor to replace the departing official, Adriana Kugler, continued until the day before the meeting when Stephen Miran was confirmed by the Senate. As well, it was a last-minute decision by the court to allow another Fed official, Lisa Cook, to remain on the job, at least until the legal case to have her removed for cause is decided by the Supreme Court.

Despite the drama, the meeting’s outcome was anything but surprising. Participants on the rate-setting committee did what was widely expected – execute a traditional quarter-point rate cut that the financial markets had fully priced in prior to the meeting. The incoming governor Miran did vote for a larger half-point cut, which was also expected as the Trump appointee had long advocated for a more aggressive easing of monetary policy. But his vote was an outlier, as a strong consensus formed around the quarter-point move; if anything, the meeting conveyed a more hawkish message than expected. Indeed, two officials who had previously argued for a more aggressive easing move than the consensus wanted, joined the majority this time in accepting a modest quarter point cut.

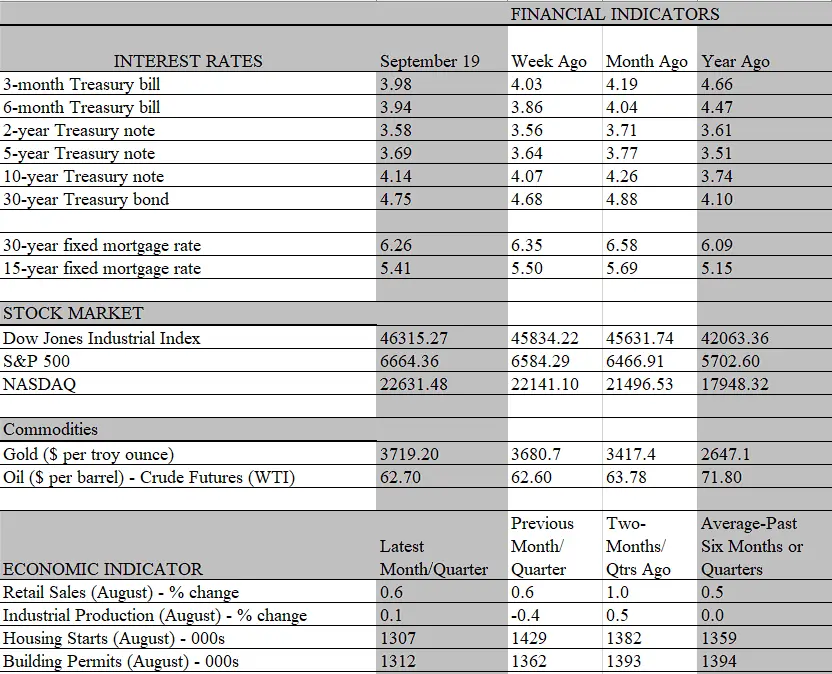

The cut was the first this year and leaves the Fed’s policy rate in a range of 4.00-4.25 percent. Fed chair Powell notes that this is still in the restrictive range and he and the committee expects to cut rates two more times this year. But that plan is not cast in stone. Powell readily admitted in his post-meeting press conference that rate decisions will be made on a meeting-by-meeting basis. That’s understandable, given the ongoing tension between the Fed’s dual mandate of maintaining full employment and price stability. At this juncture, the Fed sees a greater threat to the job market than to inflation and is taking a risk management approach to the conflict. If the job market holds up and inflation becomes hotter than expected, the Fed may well keep its finger off the rate-cutting trigger later this year.

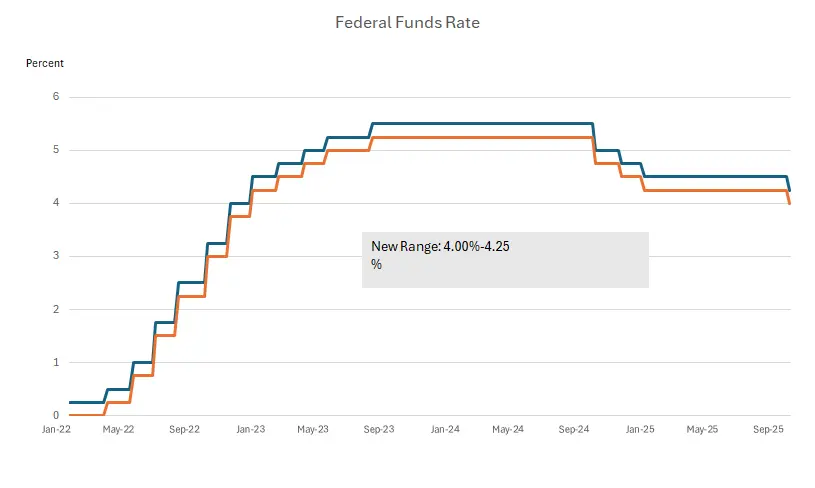

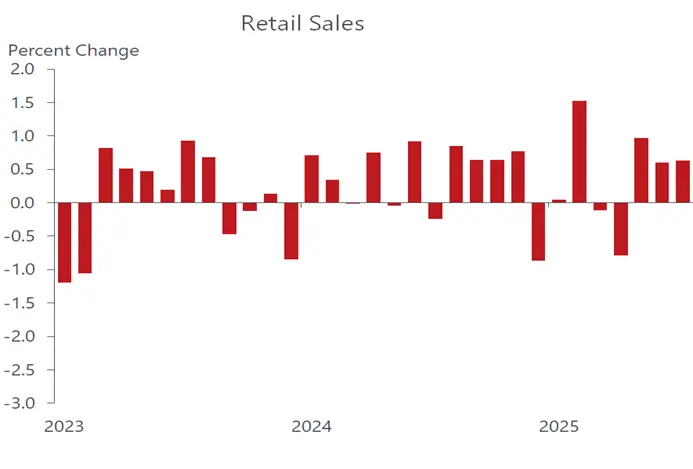

From our lens, another rate cut is likely to occur, but we think the economy – and job market – will hold up better than the Fed expects. One reason: the main engine of growth, consumer spending, is firing on all cylinders again after sputtering during the first half of the year. Among the bevy of economic reports this week, the one for retail sales stands out. The solid 0.6 percent gain in retail spending in August far exceeded expectations and the tally for the previous two months was revised higher. That rounds out three months of sturdy increases following outright sales declines in April and May. Recall that those declines came on the heels of President Trump’s Liberation Day tariff announcements, which generated a good deal of uncertainty among households. Nothing spurs inertia more than uncertainty.

But it would be a mistake to see the top line growth in sales as unbounded exuberance. Keep in mind that the retail sales report covers transactions that are made in current dollars. As noted in last week’s consumer price report, prices of all consumer goods increased a sturdy 0.5 percent in August, and the increase for core goods, excluding food and energy, rose by 0.3 percent. Hence, a good part of the retail sales increase was driven by prices. Still, even adjusting for inflation, there was a healthy gain in real purchases. Not all that gain will be captured by the GDP report, but the parts of sales that do enter the consumer spending component of GDP also rose by a healthy 0.7 percent. Hence, we suspect that consumers will provide solid support to the economy’s growth rate in the third quarter.

That said, the retail sales report further confirms that consumer spending is being propelled by a small sliver of the population, those higher up the income ladder who are deriving much of their purchasing power from assets, such as housing and stock portfolios. Both continue to forge ahead and bolster the net worth of this cohort. A look under the hood of the retail sales report provides some evidence of this skewed influence on spending. For one, discretionary sales paced the gain, including spending at restaurant and bars, which rose by a robust 0.7 percent last month and are running 6.5 percent over last year. Big-ticket items are also selling well. Notably, auto sales were expected to slip back after two months of solid gains that analysts attributed to advance purchases to beat tariffs. But auto sales staged another decent increase last month, rising by 0.5 percent, following 1.7% and 1.2 % spikes in June and July. Again, the August increase reflects in part higher prices for autos, but that is not deterring buyers from ringing up the registers at dealers.

Meanwhile, the presence of lower income households in the marketplace is also visible. With tariff-induced prices rising and pinching budgets, this cohort is looking for value, and the best place to find that is online. Even though there was no Prime Day sales event last month, shopping over the internet still advanced strongly. Online sales jumped 2 percent, the strongest monthly increase in a year, and are running more than 10 percent above last year’s levels. Price-conscious consumers should continue to drive sales in coming months, which hopefully will be a check on how much of the tariffs can be passed on to customers. So far, the pass-through has been much smaller than feared. We suspect that concern over losing customers is the main reason businesses are eating most of the higher cost of imports so far.

Indeed, the limited price impact of tariffs has no doubt given the Fed cover to lower interest rates this week. As he noted in the press conference, Fed chair Powell does expect the price impact from tariffs to become more evident in coming months. But the consensus view is that the impact will be limited, resulting in a one-time boost to prices not a sustained increase in inflation. The fact that inflation expectations remain anchored in both the financial markets and most household surveys provide some leeway for the Fed to ease up on the monetary brakes.

It’s important to remember, however, that the Fed is merely easing its foot off the brake, not stepping on the accelerator. At 4-4 ¼ percent, the Fed’s short-term policy rate is still well above the estimated neutral rate of 3 percent, which neither boosts nor stifles economic growth. Powell has stated that the Fed is in no rush to reach that rate, given the still uncertain paths of jobs and inflation. Nothing would be more damaging to the Fed’s credibility if it is forced to reverse course and lift rates next year in response to a sustained inflation outbreak. That’s not likely to happen given the softness emerging in the labor market and the struggles of lower- and middle-class consumers. Hence, the cautious start of a rate-cutting cycle is understandable, if only to retain the Fed’s inflation-fighting credibility while providing some insurance against an abrupt meltdown in the labor market. If the job market continues to weaken at the same pace as it has in recent months, the Fed can always step harder on the accelerator.