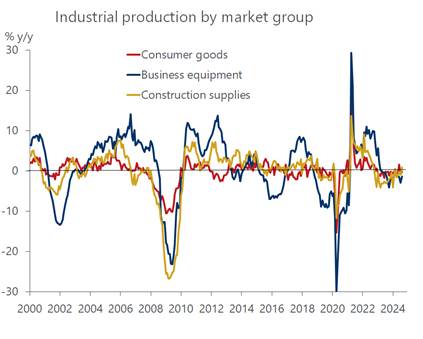

The week data calendar confirms that the economy ended the third quarter on a strong note, belying the notion it is running out of fuel. Starting with the robust jobs report for September just about every subsequent indicator for the month has been stronger than expected. The exception is industrial production, as the twin blows from Hurricane Helene and the Boeing strike clobbered factory output. The drag from Hurricane Milton and the ongoing strike will also disrupt output in October, but once those external shocks fade, production should rebound and reinforce the upward trend expected to prevail over the remainder of the year and next.

If there is one pillar of strength that is removes any doubt the economy still has firepower, it is the consumer, whose spending drives about 70 percent of total activity. Once again, reports that consumers are running out of gas and will drag the economy into a recession are proving to be premature. By all accounts, they are more resilient than expected, and as long as their wallets stay open the economy will continue to forge ahead. If the advance estimate for September retail sales is any indication, consumers are more than holding their own. Revisions can always change the narrative, of course; but the sales figures for August were actually revised higher, providing further evidence that households have the will and means to continue shopping.

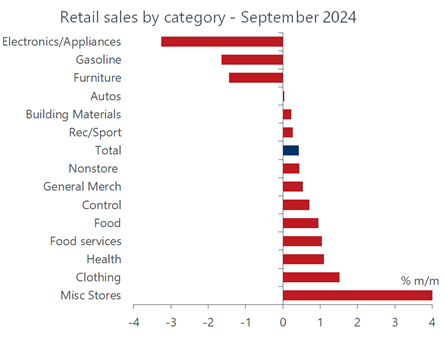

That, in turn, is keeping the cash registers at retailers ringing loudly. The numbers tell it all. Total retail sales rose a sturdy 0.4 percent last month, above the expected 0.3 percent advance. But the headline increase understates the strength of consumer spending last month, as the total was held back by a price-driven drop in gasoline purchases as well as a mild setback in volatile auto sales. Excluding gas and autos, sales leaped by 0.7 percent, more than double expectations. More impressive is that the sales gains were widespread, with 10 of the 13 major retail categories staging advances

Looking at the details, outside of the price-driven drop in gasoline sales, the only categories to show weakness were housing related, including declines in furniture, appliances, and large electronics. More than likely, those declines were heavily influenced by Hurricane Helene, which paused construction activity and home sales through much of the South in the final week of the month. Hurricane impacts will also disrupt the next few retail sales reports. Hurricane Milton should depress sales in October, as the storm walloped Florida early in the month, sending shoppers to safety and preventing goods from reaching shelves. But just as October sales will be depressed by the hurricane impact, November will see a significant bounce from returning shoppers restocking cabinets and, importantly, from the reconstruction of destroyed property.

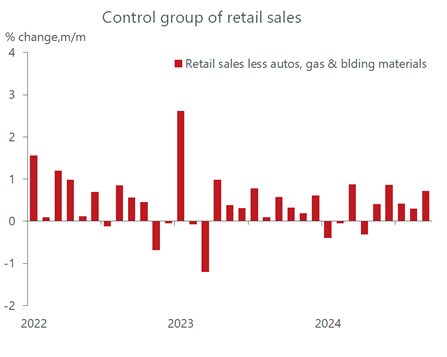

Looking beyond the distorting impact of weather and strikes, the behavior of consumers could not be more impressive. The so-called control group of sales that tracks personal consumption in the GDP accounts gained a muscular 0.7 percent, more than double the August increase. A notable contribution to the increase was the 1.0 percent surge in food service sales, triple the average monthly increase over the past year. This is significant because it is the only retail sales category, which is mostly for goods, that includes service providers and suggests that sales of services by far the largest expenditure category of households also fared well last month. We will have evidence of that in the more comprehensive income and spending report due out later this month.

Keep in mind that retail sales are not adjusted for inflation, but the nominal increase of 0.4 occurred amid a 0.2 percent decline in goods prices last month, as shown in the CPI report last week, so the increase was even stronger in real terms. The income and spending report will also reveal real purchases of goods and services for the month and will be the final reading for the third quarter of the most important driver of GDP. We estimate that real personal consumption expenditures posted a growth rate of over 3 percent for the quarter, underscoring another solid increase in GDP. This economywide measure may be lower because of drags from international trade and business inventory investment. But the sustained health of the economy is determined by consumer and business spending, and both are expected to put in a strong showing and provide momentum heading into the fourth quarter.

In this environment, some are understandably questioning whether the Federal Reserve should continue cutting rates in November and December, which is assumed in the Summary of Economic projections presented the last policy meeting in mid-September. Until recently, the consensus view was that the next cut would equal the jumbo-sized half-point reduction taken at the September meeting, followed by another cut in December. But with the robust economic data release since the meeting, that notion has been completely dismissed by traders; now the question is, will the Fed skip a rate cut completely at the upcoming November meeting. Some believe that the Fed could move to the sidelines for the rest of the year.

Clearly, the latest batch of numbers indicate that the economy needs little help from lower rates, as it is doing just fine at current levels. But the reason the Fed has lifted rates as high as they are and as aggressively as they did � is to wrestle unruly inflation down to normal, which is targeted at 2 percent. That mission has not been complete but is well on the path to success. The road has been bumpy, as expected, but the disinflationary trend has stayed intact despite the economy�s healthy performance. True, job growth has been stronger than expected, leading skeptics to wonder if the Fed should have shifted its focus away from controlling inflation towards supporting labor conditions.

That issue will go unresolved for a while and should become more complicated by the noisy data we expect will unfold in coming months due to the hurricane impacts and the Boeing strike. For example, there is a very real possibility that the next employment report will show that the economy lost jobs in October, which may well inflame recession fears and turn the skeptics of the Fed rate-cutting campaign on it head. We doubt the Fed will react to a single report in a knee-jerk fashion and will instead keep its eye on the bigger picture. The economy remains on a solid footing, supported by households whose spending behavior is being bolstered by healthy balance sheets, including a revised upgraded cushion of savings, growing incomes linked to solid wage gains and gradually lowered borrowing costs on mortgages, auto loans and credit cards. Meanwhile, strong productivity growth and cost-conscious shoppers should continue to limit price increases and sustain the disinflation trend. As long as a healthy pace of economic growth does not reignite the inflation embers, the Fed can continue on a measured rate-cutting path. Its goal at this point is not to add vigor to the economy, but to normalize policy, bringing rates back to a level that neither stimulates nor curbs activity. The current policy rate is well above that neutral level, justifying continued cuts. It�s unclear where the neutral level is, but it is certainly below the current level.