We are entering the dog days of summer, and the oppressive heat and humidity are, on schedule, buffeting the weather-weary victims of Mother Nature. Another target taking the heat is Federal Reserve chair Powell whose refusal to cut interest rates is drawing withering criticism from President Trump. Unfortunately, Powell cannot escape to an airconditioned room, as the only potential relief would come from a blast of economic reports justifying an accommodating response. No such savior will appear before the upcoming FOMC meeting concludes next Wednesday, setting the stage for more uncomfortable attacks in coming weeks.

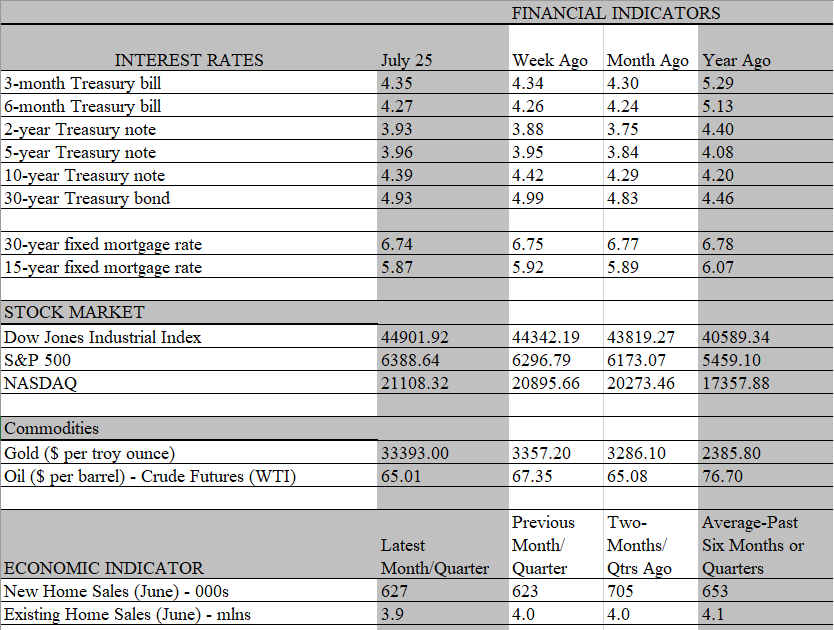

The consensus view is that the Fed will hold rates steady at its confab, although it may convey a slightly more dovish message than was the case at the June meeting. Two Fed governors have already indicated a preference for a rate cut and are likely to dissent from the majority view to retain a wait-and-see strategy. The meeting will take place amid a bustling week of economic reports, including the all-important monthly employment report for July. It will also include the first estimate of second quarter GDP as well as key personal income and spending data that will reveal how much momentum the economy’s main growth driver provided at the end of the period.

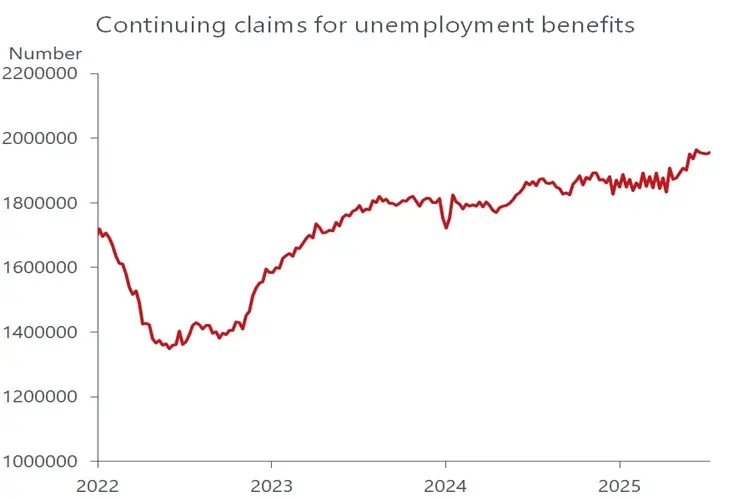

We doubt that that the large data drop will materially alter the prevailing view that the economy is holding up and the job market is far from collapsing. All the signs point to a modest slowdown in activity and softer but still resilient labor conditions. Weekly claims data continue to show that employers are reluctant to lay off workers, as initial applications for unemployment benefits remain low. But employers are also reluctant to step up hiring amid uncertainty over tariffs and future sales. The low hiring rate, in turn, means that job seekers are staying on the unemployment lines longer, as evidenced by the steady climb in the number of continuing claims for benefits.

The good news is that tariff-related uncertainty may wind down following the recent deal with Japan and speculation that a similar accord with the EU is close to being finalized. The faster deals with major trading partners are struck the sooner the Fed can more confidently predict how tariffs would impact inflation. The extent of the passthrough to consumers would still be unclear for a while, but at least the upper limit of the price impact would be known. Then the focus could pivot to the response by consumers and, by extension, the job market. The tariff-related price bump will erode real incomes and take some steam out of spending. That, in turn, should weaken the reluctance of companies to reduce staff, opening the door for the Fed to start cutting rates later this year once the price shock from tariffs is absorbed.

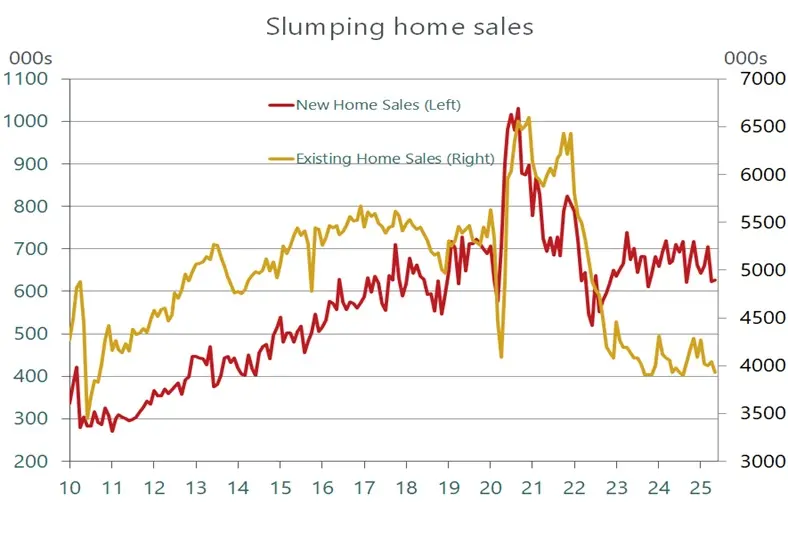

One sector that could benefit from lower rates Is housing, where struggles with affordability continue to weigh heavily on sales. Home sales have languished since mortgage rates climbed into the 6.5 to 7.0 percent range for most of the past two years. While price incentives by home builders have limited the weakness in new home sales, no such concessions are seen in the market for existing homes, which accounts for more than 80 percent of all transactions. In June the median price of existing homes hit another record, climbing to $435 thousand. The rise in home prices have far outpaced the increase in household real incomes, pushing swathes of potential home buyers out of the market.

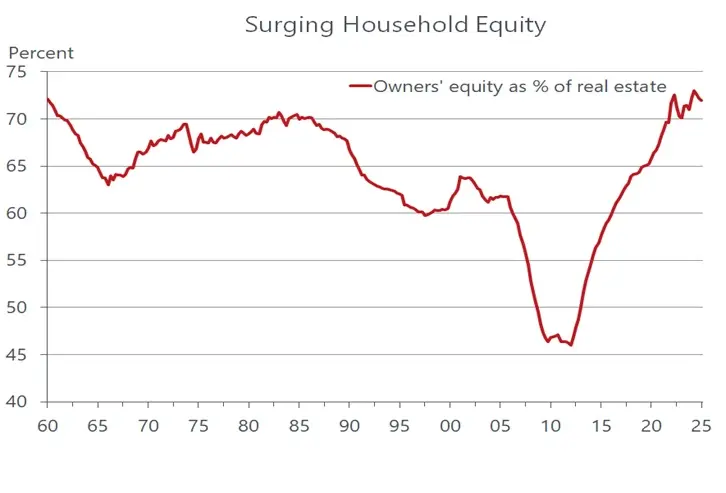

At the same time, high mortgage rates have locked in owners who hold mortgages taken out when rates were much lower at the time of the home purchase. While this has discouraged them from putting homes on the market, they are sitting on an appreciating asset that has greatly boosted their housing wealth. The equity stake of homeowners has hovered around the highest levels since the 1960s, generating an equity cushion of more than $34 trillion. That’s formidable collateral against which homeowners can borrow to sustain consumption or at least tide them over until more favorable market conditions encourages a sale. Indeed, home equity loans at banks increased 5.1 percent in June from a year ago, the strongest monthly increase since late 2009.

With stock prices hitting new highs, the collective balance sheets of households remain in good shape and should provide a modest wealth boost to consumer spending. The headwinds threatening the economy this year have been dominated by uncertainty over tariffs, which, as chair Powell has noted, is the main reason that the Fed has not cut rates. Some encouraging news this week suggest that the chaos over trade policy may be nearing an end. More clarity on this front would go a long way towards encouraging the Fed to resume normalizing policy, even if the economy continues to outperform expectations. Long-term inflation expectations have remained relatively anchored throughout the tariff hubbub, and there are no other obvious sources of inflation pressure on the near-term horizon.

The upcoming batch of data next week should provide a good sense of the economy’s momentum heading into the third quarter. We expect that it will show enough oomph to give the Fed leeway to stay on the sidelines until December. However, we recognize the pressure on the Fed to cut rates sooner rather than later; if the upcoming reports come in on the weak side and trade tensions subside, the odds of a rate cut at the September meeting would increase. Indeed, traders are already pricing in a greater than 50 percent chance that the Fed will pull the rate-cutting trigger at that meeting.