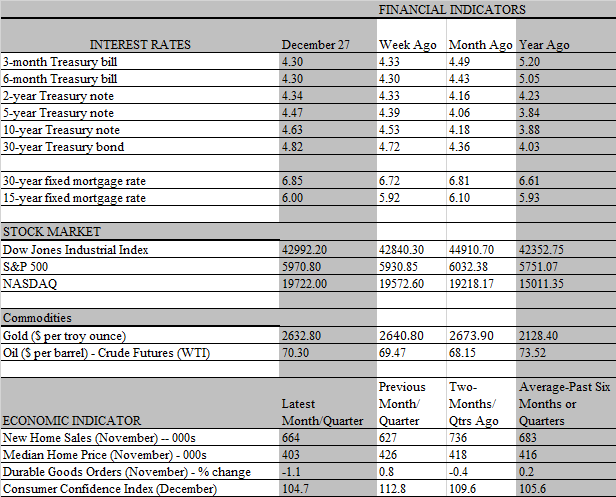

The modest Santa rally was rudely interrupted on Friday, as prices slumped amid light trading during this holiday-shortened week. Meanwhile, bond yields continued to tilt higher since the Fed announced its latest rate cut on December 18, moving from 4.40 percent to above 4.60 percent to end the week. Again, its hard to read much into market sentiment during the holidays, when traders take vacations and a few large transactions can have an outsized impact on prices. What�s more, there was little in the way of market-moving economic data that would warrant a move in either directions. The next influential report will be released on January 10, when the all-important jobs report for December comes out.

To be sure, that report will not be entirely clean, as the negative effects of the hurricanes and the Boeing strike are still working their way through the economic data, causing wild swings in employment, housing, industrial production, and durable goods orders. Those influences were clearly evident in the sparse batch of economic data released this week. The most visible occurred in the housing market, where weather conditions can have an outsized impact. Sales of new homes bounced back in November, but the rebound reflected a recovery from the hurricane depressed pace in October, which saw sales in the South plunge by 22 percent.

Even so, sales have moved essentially sideways throughout the year, reflecting crosscurrents that continue to weigh on the market. Homebuilders have had to offer price and other incentives to keep sales moving and to offset the impact of sticky mortgage rates, which have hovered between 6 and 7 percent over the past 12 months. That’s well above the 3-4 percent range that prevailed for most of the decade before Covid hit. But there are signs that homebuyers are gradually becoming more accepting of the higher rates, believing that the era of low rates is not likely to return. Hence, they are more inclined to pull the trigger on a home purchase. If so, that would go a long way towards clearing up the backlog of new homes on the market, which reached 490 thousand in November, the highest since December 2007. That translates into an 8.9-month supply at the current sales pace, well above the 6 months supply that is considered to represent a balanced housing market.

Of course, affordability is a key problem in the housing market as the combination of high mortgage rates and home prices have outpaced growth in income and shoved many homebuyers, particularly first-time buyers out of the market. So, the fortunes of homebuilders and the overall housing market will depend in good part on the income-capacity of house-seekers to afford a home. That, in turn, will depend on the continued strength of the job market and wage growth in the coming year. From our lens, the demand for labor should hold up in 2025; and while wage growth should slow so too will inflation, allowing real disposable income to continue to grow.

However, the job market is becoming harder to read as recent reports, like those in the housing market, have been disrupted by hurricanes and strikes. Indeed, more external shocks on the labor front may well occur early in the new year, as a potential U.S. port strike looms next month. The International Longshoremen’s Association ended a three-day strike in October at certain East Coast and Gulf Coast ports until mid-January. Should they return to the picket lines if an agreement is not reached, the implications would be broadly felt. A further strike would cause full work stoppages at ports that handle nearly 35% of all US imports and exports, with the biggest impacts on trade coming from the Ports of New York-New Jersey and Houston-Galveston. We estimate that for each week a strike occurs, it would take a month to clear the backlog, partly because West Coast ports are approaching capacity. Simply put, a strike would result in another round of product shortages and potentially a spike in prices, at least until the affected goods wind up on retailer shelves.

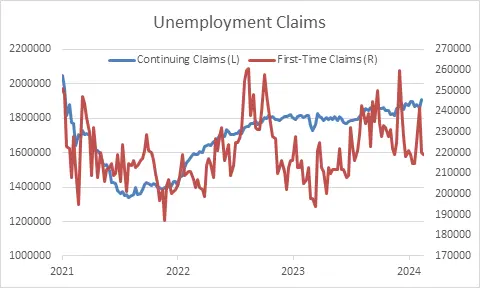

More immediately, the job market looks healthy as sales are holding up and keeping the unemployment rate down. What’s more, businesses may be retaining workers in anticipation of higher prices from announced tariffs that could prompt consumers to accelerate purchases to beat the price hikes. To the extent that is the case, of course, there would be a payback later when sales would presumably drop off. Still, there are signs that labor conditions are not as strong as recent employment data suggest. True, layoffs are historically low, which reflects the ongoing strength in sales as well as the sustained low level of first-time claims for unemployment benefits. But continuing claims are rising, hitting a three-year high in the latest week. That suggests it is taking longer for an unemployed worker to find a job.

Another reason to hold on to workers is that they will be needed to operate the equipment that businesses are aggressively buying. This trend is a two-sided sword, however, as much of the capital spending is for labor-savings machinery aimed at boosting productivity and restraining labor costs. That said, the outlays boost GDP as well as productivity, which helps keeps inflation down. That, in turn, should allow the Federal Reserve to lower interest rates and keep consumers in a buying mood. And, as noted earlier, lower inflation allows worker paychecks to go a longer way so, even as the job market cools, household purchasing power should continue to increase. The stars are aligning for the economy’s main growth driver consumer spending to keep their wallets open as we enter the new year.

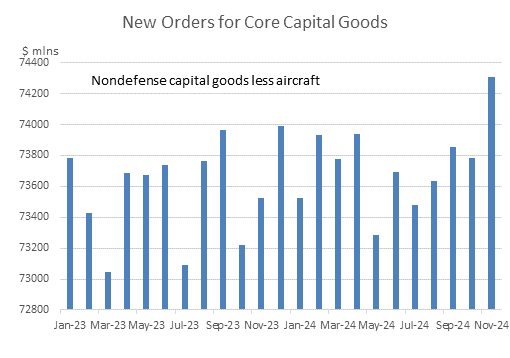

Meanwhile, business capital spending should do some of the heavy lifting as the calendar turns to 2025. In November, new orders for core capital goods spending total durable goods orders less volatile aircraft bookings rose a robust 0.7 percent, the strongest monthly advance since May 2023. These orders are a reliable indicator of capital spending a few months from now, pointing to continued strength early next year. However, some of the strength in bookings presumably reflects easing policy uncertainty now that the election is behind us. In the run up to the election, the Richmond Federal Reserve Bank found that election-related uncertainty had prompted a fifth of surveyed firms to postpone their investment plans. Like the behavior of consumers when tariffs take effect, the post-election rebound in capital spending should begin to fade over the next few months.

Looking through the noisy data in recent months, we think the US economy is doing well. GDP growth is near its short-run potential, unemployment is low, consumers are spending, and manufacturing is showing signs of improvement. For whatever reason tax-loss harvesting, profit-taking, uncertainty over policies, geopolitical tensions or just a run-of-the-mill temporary correction the markets ended the week on a sour note. A one-off correction is not alarming, but market developments need to be monitored closely as a guide to the economy’s health. Keep in mind that the strength in consumer spending last year was driven by higher income households whose financial conditions were buoyed by strong wealth gains. Any lasting correction in the stock market would make a dent in that wealth, which would potentially feed into a weaker spending stream.