The government pressure on the Fed to cut rates next month has reached a fever pitch, with the president, Treasury secretary and other administration officials, not to mention some members of the rate-setting policy committee, all chiming in to provide Fed Chair Powell reasons to do so as quickly as possible. Most also want the Fed to go beyond the normal quarter-point cut, slashing by at least a half percent at the upcoming meeting. Traders are also mostly convinced the Fed will make a move on September 17, as the market is pricing in more than a 90 percent chance that a quarter point reduction is in the bag. A month ago, those odds were still high, but barely above 50 percent.

Clearly a lot has happened on the economic front between mid-July and now. The most conspicuous and impactful is that job growth in recent months has turned out to be much softer than thought. The astonishing downward revision that clipped 258 thousand jobs from the earlier estimate for May and June, plus the uninspiring 73 thousand payroll increase in July came as a jolt to market observers. Since the Fed is keenly aware that one side of its dual mandate – fostering maximum employment – has come under threat, the shift in expectations regarding a rate cut comes as no surprise. Two Fed officials have publicly stated that they would vote for a rate cut at the September policy meeting, and Trump’s appointee – Stephen Miran — to replace retiring Fed governor Adriana Kugler would almost surely cast a similar vote if he is confirmed by the Senate on time for the September 16-17 confab.

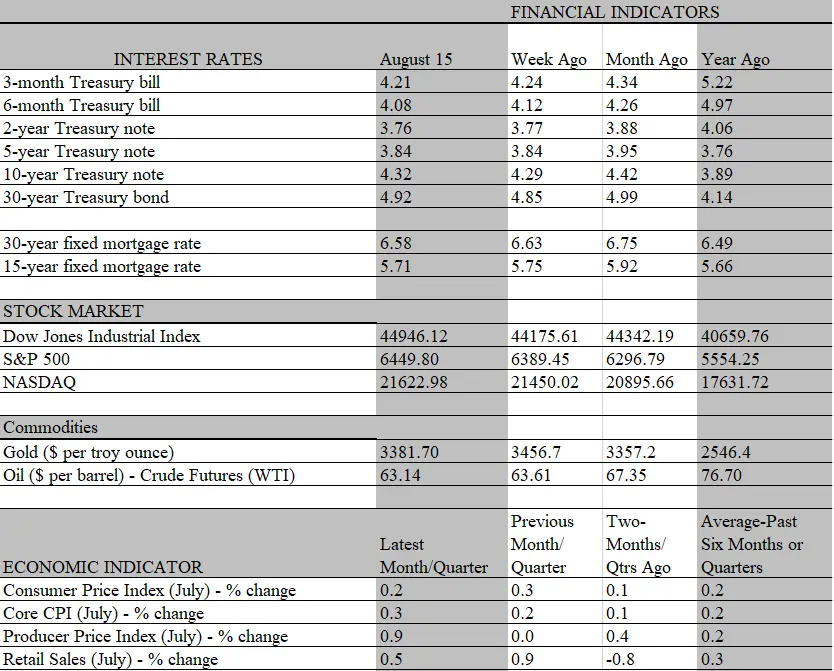

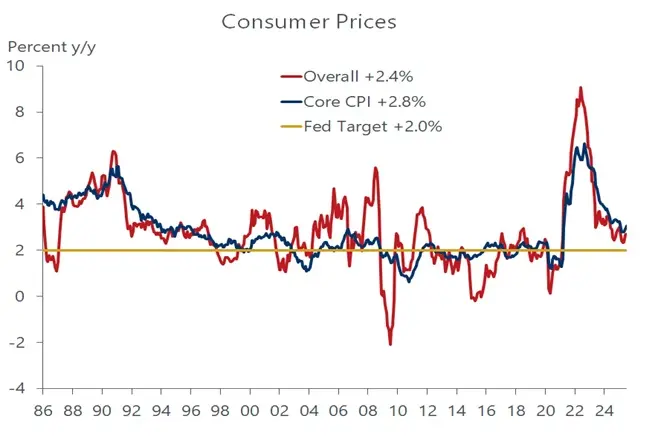

But that would still not be a consensus among the 12 voting members of the FOMC committee, and data out this week may well persuade many on the fence to think twice before pulling the rate-cutting trigger. Keep in mind that policymakers are just as vigilant in pursuing the other side of its dual mandate, maintaining price stability, and they may feel that there is still a ways to go before that side of the ledger is satisfied. Indeed, the inflation data released this week does, on the surface, provide more reason to keep rates unchanged. Recall that inflation has stubbornly remained above the Fed’s 2 percent target this year, stalling out following the steady decline over the last half of 2024. The consumer price report for July confirms that progress on that front continues to be elusive.

To be sure, the overall CPI report was not shocking – certainly not as earth-shattering as the July jobs report. The headline trend came in much as expected, with the overall CPI rising by 0.2 percent during the month, keeping the increase over the past year steady at 2.7 percent. A major influence holding back the rise was the drag from falling energy and gasoline prices, which fell by 1.1 percent and 2.2 percent respectively. But economists like to look at the core CPI to gain a better sense of underlying inflation. This metric, which strips out volatile energy and food prices, increased by a somewhat hotter 0.3 percent during the month, which bumped up the increase over the past year from 2.8 percent to 3.1 percent.

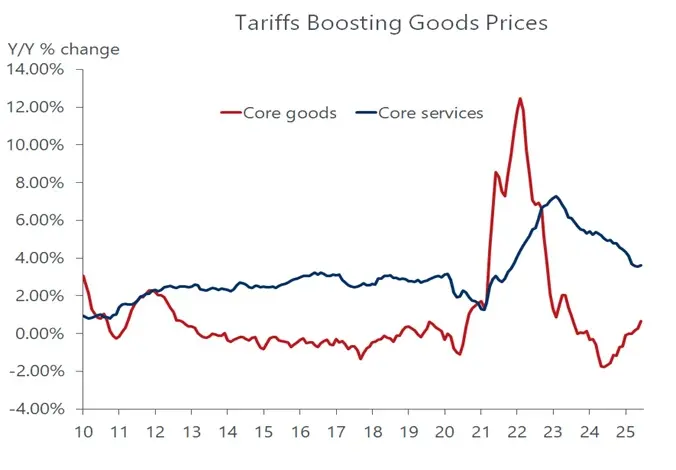

A 3 percent inflation rate is not something to fret over, particularly when viewed against the 9 percent pace seen during the worst of the post pandemic inflation cycle. But it is trending in the wrong direction and still does not fully capture the impact from tariffs, which were reset again in August and are starting to seep through into some prices. Core goods prices, which, unlike service prices are exposed to tariff, are rising by the fastest annual rate in two years. The items most exposed, furnishings, appliances, apparel and autos, are seeing the strongest price increases. What’s more, the passthrough is poised to broaden and strengthen in coming months, as inventories purchased in advance of tariffs are being run down and businesses will be hard-pressed not to pass on some of the higher cost of newly imported goods to consumers.

How much of the cost will be passed on to customers is unclear. Businesses have been enjoying healthy profits and are no doubt willing to see some margin compression to avoid losing sales. But another report this week showed that wholesale prices jumped by an eye-opening 0.9 percent in July, which far outpaced the consumer price advance, suggesting that squeeze may be more imminent than thought. We caution, however, that the jump in producer prices followed several months of weak readings, so the July jump may be more noise than substance. One or two months of higher wholesale prices may not be enough to cause businesses to alter their pricing behavior, particularly if they are not sure if the tariffs will be reduced as the Trump administration pursues deals with trading partners.

More important for the Fed’s decision-making process, is that higher prices are not putting the kibosh on consumer spending. True, households have pulled in their reins over the first half of the year, keeping the increase in real consumption to under 1 percent. But if the retail sales report for July, out this week, is any indication, they are proving to be more resilient than expected. Overall sales increased by a solid 0.5 percent last month, powered by robust auto and online sales, as Amazon extended its prime-day promotion by a few days, something that the seasonal factors could not adjust for.

It’s important to remember that retail sales consist mainly of goods purchases, and they are expressed in nominal dollars. Adjusted for inflation, the sales picture looks somewhat dimmer, particularly since, as noted, core goods prices in the CPI jumped by the fastest pace in two years. Hence, higher prices accounted for a big chunk of the retail sales increase last month. Even so, the fact that sales more than kept up with inflation suggests that consumers are still accepting the higher-priced goods. One reason, of course, is that wage increases are also keeping pace with inflation. Indeed, one bright spot in the otherwise dismal jobs report is that real average hourly earnings of workers increased again last month and are up by more than 1 percent over the past year.

With consumers still spending and inflation still elevated, the Fed would seem to have the luxury to wait a bit longer to cut rates. We still think there is a strong possibility that will turn out to be the case. However, we also recognize that the risk of keeping rates elevated is greater than the risk of a rate cut. It’s doubtful that a small rate reduction would have much of a stimulative impact on the economy or cause a significant boost to inflation or inflationary expectations. Conversely, with labor conditions turning much weaker than perceived a few weeks ago, the Fed might believe that an insurance cut at this point provides more good than harm. Underpinning this logic is that it is easier to curb inflation than it is to arrest a deteriorating job market once it gets underway. Not only are most measures of employment lagging indicators – reflecting staffing decisions made months earlier – but, as we have just seen, they are also vulnerable to sizeable revisions that may tell a much different story than the one portrayed by the latest job report. On a helpful note, the Fed will receive another report on jobs and inflation prior to the mid-September meeting, providing critical new information to guide its decision. Stay tuned.