Looking back, the Fed had some good luck in its now-concluded rate-hiking campaign. Recall that at the outset inflation had accelerated far faster and longer than the Fed expected, and Chair Powell warned that the economy would likely come under some pain from the growth retarding rate increases being put into effect. It was widely believed that the Fed would even accept a mild recession as a trade-off for bringing inflation under control. As it turned out, the economy retained more resilience than expected and it survived largely unscathed by the most aggressive tightening of monetary policy since the 1980s.

For a variety of well-annotated reasons, the bite from the rate hikes proved to be less damaging than expected, and the prospect of achieving the rare soft landing � bringing down inflation without causing a recession � looks highly promising. The question now is, will the Fed have as much luck in its rate-cutting campaign as it did when traveling in the opposite direction. The goal this time will be to keep the economy chugging along without stoking a flareup in inflation. From our lens, the odds look pretty good that the effort will be successful. There is always the danger, of course, that recency bias colors this assessment. At this juncture, the economy is in a sweet spot, with inflation moving sustainably towards the Fed�s 2 percent target, unemployment remaining close to historically low levels and GDP forging ahead at an above-trend pace. Naysayers will point out that this confluence of events is fleeting and a policy misstep or an external shock is likely to derail the economy from its promising course.

They may be right, but investors are fully on board with the more optimistic view, at least for now. The day following the Fed�s meeting, stock prices surged to new records while the bond market remained relatively calm, recouping only a small fraction of the large yield decline over the past several weeks. While the euphoria not surprisingly faded on Friday, the initial reaction depicts an investor mindset that is more Goldilocks than fearful, perceiving sustained growth ahead (and better profits) with only a mild uptick in longer-term inflation. That echoes the Fed�s projections, which tweaked its long-term neutral rate a touch higher to allow for slightly higher secular inflation. Interestingly, Powell hinted that the Fed would have cut rates earlier at the July meeting if it knew the job market had softened as much as indicated in the August jobs report, released two weeks after the meeting.

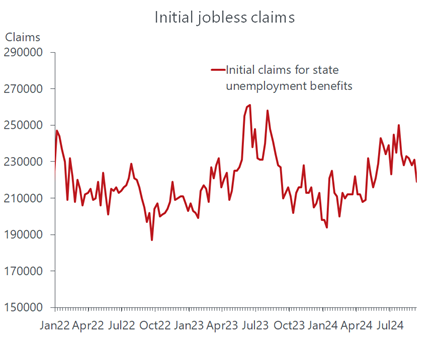

But that remorse may be unwarranted. More recent data show that the economy is heading into the fall season on a solid footing. While the labor market is cooling, with hiring slowing and employers posting fewer openings, it is moving towards balance rather than falling apart. Layoffs remain low as companies view demand and revenue prospects as strong enough to retain staff. Importantly, their confidence is being vindicated by events. Sales are not only holding up, but they are also exceeding expectations as consumers are keeping their wallets wide open.

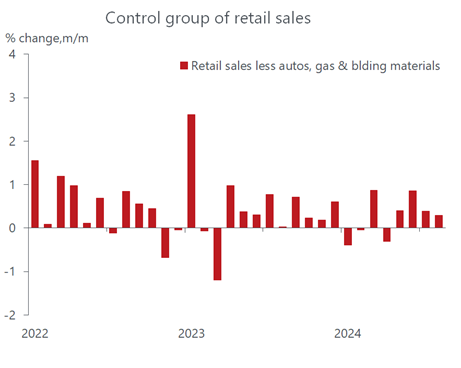

As evidence of consumer resilience, this weeks report on retail sales delivered another upside surprise. Total sales in August rose a slim 0.1 percent, but expectations were for a decline following the strongest increase in July since January 2023, stoked by a surge in auto sales. As expected, auto sales fell back last month, but by less than anticipated. The setback was joined by several other categories as well reflecting a more selective buying pattern among households paced by another price-related drop in gasoline sales. One key disappointment was the weakness at bars and restaurants, which showed no gain in August for the first time since March, suggesting that weak spending in the broader service sector may be offsetting the strength in goods purchases. But spending at bars and restaurants could be temporarily disrupted by special influences, such as weather, so it would be a mistake to read too much into August. Following the setback in March, sales at eating and drinking establishments rebounded strongly in April.

More important, the components of retail sales that feed directly into consumer spending in the GDP accounts sales excluding building materials, autos, food and gasoline staged a healthy 0.3 percent gain in August. This strength in this so-called control group of sales received considerable heft from online sales, which leaped by 1.4 percent and now account for a record 21.4 percent of total nonauto sales. The 0.3 percent advance in the control group of sales follows a 0.4 percent increase in July. What�s more, these sturdy back-to-back increases come off an elevated level of sales at the end of the second quarter, following a blockbuster gain in June. Hence, barring an unexpected setback in September, consumer spending should provide considerable impetus to the economys growth rate in the third quarter.

With the economy firing on its most important cylinder, consumers, some are understandably questioning why the Fed opted for the bold half-point cut at its latest meeting instead of the more traditional quarter point move. While the more aggressive undertaking may not matter much in terms of an immediate impact, it has become abundantly clear that the current policy stance was far too restrictive, given the ongoing inflation retreat and the cooling in the labor market. The latter is particularly important because historically when labor conditions start to buckle it tends to break, and the Fed is keenly aware of the risk of falling behind the curve. Thanks to falling inflation, disposable incomes are still showing real gains. But nominal wage growth is slowing and as the job market continues to cool, the risk is that wages will hop onto a steeper downward slope than inflation, eroding household purchasing power. At that point, the issue will be whether the wealth gains that have been a critical source of spending by mid and upper-income households will continue to do the heavy lifting necessary to keep the economy afloat.

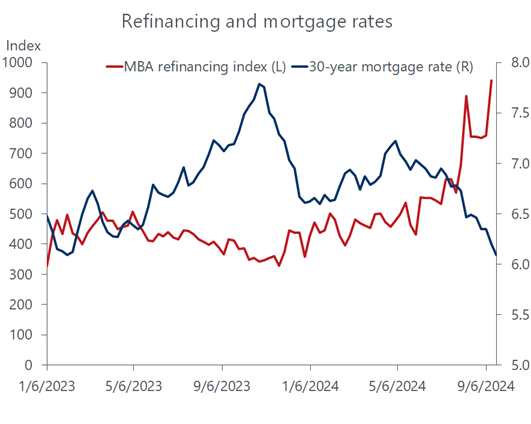

The preemptive strike by the Fed may also be serving another purpose. Keep in mind that the highly anticipated rate cut had already sent market yields sharply lower, but it is only recently that the expectation grew of a half point cut. That plus the dovish message conveyed at the latest policy meeting could well give another push down in market rates. This would resonate importantly in the struggling housing market, where lower mortgage rates should help alleviate the affordability issue that is keeping a lid on sales. What�s more, homeowners have a huge cushion of housing equity that has been locked in by high mortgage rates. The 30-year rate is on the cusp of falling below 6 percent from a 7.8 percent peak last fall, which is already unlocking some of that equity as refinancing applications are surging. Except for a spike in early August when mortgage rates dropped by 26 basis points in one week, the MBAs refinancing index staged its largest one week advance in early September since March 2022, when mortgage rates were hovering below 4 percent. With homeowners sitting on $35 trillion of housing equity, there is a formidable pool of equity extraction on tap to support spending even as labor conditions continue to cool.