As the shutdown enters its third week, the sun is still shining on the economic landscape. But the longer it persists, the sooner will the clouds start to darken. Already the shutdown is the second longest on record and it is shutting down more government functions than previous ones. The odds that it will set a new record for longevity (35 days) is growing, as both sides of the political aisle are digging in. For the most part, the public is shrugging off the impasse and Wall Street continues to thrive, although the remarkable three-year rally in stock prices is showing signs of sputtering as questions about credit strains at some regional banks are raising alarms.

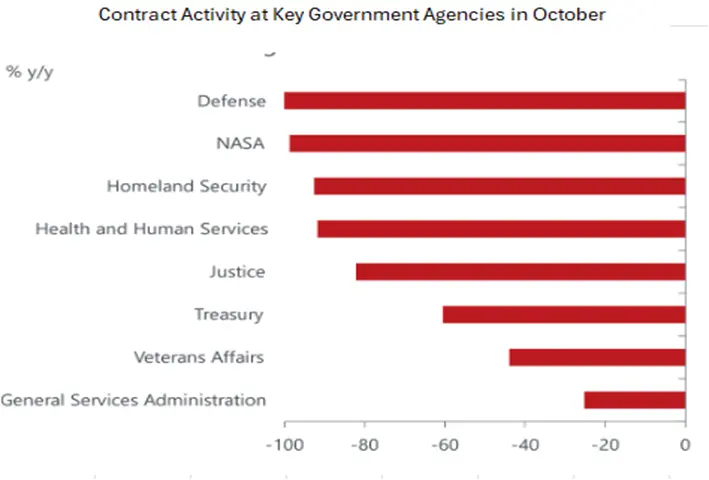

The pain will intensify when the impact is more strongly felt on Main Street. That may be about to happen. Up until now, the 700 thousand furloughed Federal workers received paychecks. But the last one hit bank accounts on Friday, and if the impasse continues the next one that would otherwise arrive on October 31 will be missing, removing a big slice of purchasing power from the economy. What’s more, the shutdown is having ripple effects elsewhere, as it forces many government contractors to shut down – and lay off workers. Already, month-to-date contracts obligated in October are down precipitously from a year ago across many of the largest contracting agencies. The federal award spigot has all but turned off at the Department of Defense, NASA, and the Department of Homeland Security. As well, funding for government assistance designed to help lower income households – food assistance (or SNAP) being the most visible— would be cut off beginning in November, putting a squeeze on the budgets of the most vulnerable segment of the population.

By ours as well as many other estimates, each week the government stops functioning slices 0.1 -0.2 percentage points from the GDP growth rate, which translates into a weekly haircut of $7.6 – $15.2 billion. The drag comes from both the income and output sides of the ledger. Reduced Federal compensation removes a big chunk of incomes while the slashing of hours worked by government employees puts a big dent in output. To be sure, once the doors of government reopen, those losses are expected to be recovered. That happened in the past and the pattern should repeat this time as well. Following the downdraft during the previous longest shutdown of 35 days that ended in early 2019, GDP rebounded strongly.

We caution, however, that there are more headwinds looming in coming months than was the case in the immediate aftermath of the previous shutdown, most notably the heightened trade tensions and stubborn inflation. In early 2019, inflation was running at 1.5 percent, down from 2.5 percent a year earlier. Currently – at least through August, since the shutdown has delayed the CPI report – consumer inflation is running at 2.9 percent and has remained stuck in a 2.5-3.0 percent range for the past year. According to industry reports and the Fed’s Beige Book released this week, consumers are increasingly sensitive to higher prices, shopping for cheaper alternatives or sacrificing purchases that have become too expensive. Here’s a direct quote from the latest Fed roundup of reports from bank districts around the country the enters the Beige Book:

“Several reports highlighted that lower- and middle-income households continued to seek discounts and promotions in the face of rising prices and elevated economic uncertainty”.

That said, aggregate spending has yet to buckle, despite these headwinds as well as the drastic slowdown in job growth underway before the shutdown began. Indeed, we expect a solid holiday sales season, with retail sales expected to increase 4.6 percent over last year in dollar terms, and 1.6 percent in volume terms. The gain in volume would be the strongest since 2021, and not far below the 1.8% average growth seen in 2015-2019, before the pandemic-related swings in goods spending. The seeming contradiction between strong sales and weak job growth can be reconciled by looking at the stock market, and the enormous wealth it has created for shareholders. The so-called wealth effect on sales could not be overstated, as it has arguably been the biggest driver of consumption in recent years.

Indeed, households’ direct and indirect equities holdings are two and a half times their incomes at the end of the second quarter. surpassing real estate holdings. The wealth held in stock portfolios is much higher than it was at previous peaks, such as during the dot-com bubble, the global financial crisis, or the onset of the pandemic. Importantly, however, these holdings are held primarily by upper-income households and their spending is the biggest influence on overall consumption. Needless to say, fluctuations in stock prices have a big influence on sales of discretionary goods and services, a market which wealthier households dominate. As can be seen in the chart, the stock market slump in the first quarter – reflecting mounting tariff uncertainty – coincided with a sharp pullback in sales of travel and recreational goods and services. That pullback reversed as the stock market roared back, driving a recovery in those sectors.

That experience, of course, also highlights the fact that the wealth effect runs both ways, as the stock market gives as well as it takes. Should the bull market morph into a bear, the positive wealth effect would reverse and possibly have an amplified negative impact on the economy. Keep in mind that the 10 percent richest households – who are the biggest holders of stocks – account for more than 50 percent of total consumer spending, which, in turn accounts for about 70 percent of GDP. What keeps market analysts up at night is the fact that the latest phase of the stock market boom is being driven by a handful of AI-related stocks, which evokes memories of the dot-com bust twenty-five years ago. Unlike then, however, the so-called Mega stocks of today are generating substantial revenues and are expected to stay profitable in coming years. Still, the fact that so much wealth is linked to the fortunes of so few companies is not something that is particularly comforting to policy makers.

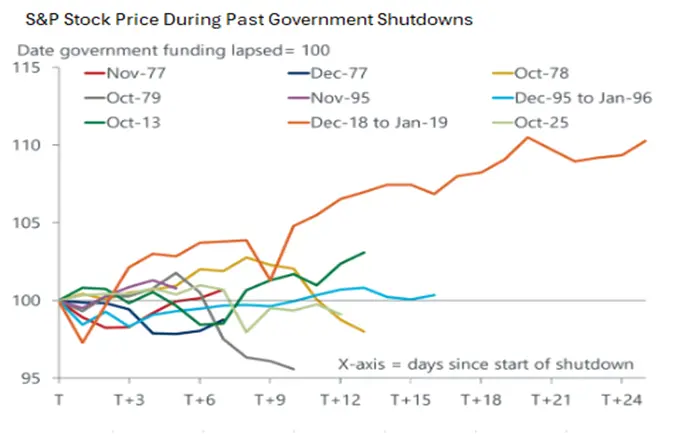

On this score, you would think that the negative impact on the economy from the government shutdown would unsettle the stock market and put pressure on legislators to break the impasse. But the past experience suggest that the stock market pays little heed to the foibles on Capitol Hill. Presently, there doesn’t appear to be an immediate catalyst for a resolution to the budget standoff. A key pain point that stood the best chance of bringing about an end to the shutdown was taken off the table this week when the Trump administration shifted funds from other government accounts to cover the mid-month paychecks of active-duty military personnel. The most important question is whether the shutdown will bleed into November. If so, the risks to the economy will become amplified as it’ll collide with the holiday shopping season. Our sanguine forecast of sales noted above assumes that the doors will reopen before festivities begin and does not stoke a surge in uncertainty that plunges household sentiment into recession territory.