The vibe-recession may still be alive and well, but incoming data, if sustained, is sure to loosen its grip. While economic data may not be the best measure of happiness, they certainly look more upbeat than how people are feeling. That divergence has persisted for some time now and, unsurprisingly, the gap is beginning to narrow. Following several months of stronger-than-expected data, the Conference Boards Consumer Confidence index shot up in October, staging its biggest monthly advance since March 2021 and reaching the highest level in 10 months. No doubt, subjective influences played a key role in the gain, including greater optimism stoked by surging stock prices, which a record number of respondents expect to continue over the foreseeable future.

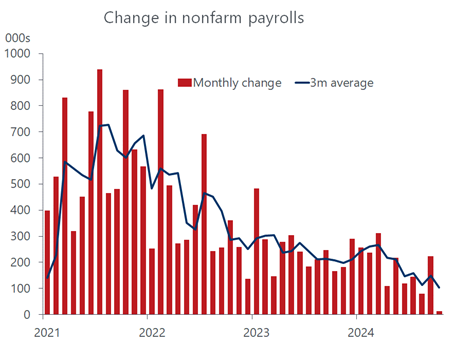

But meat and potato issues are also boosting morale, and the latest batch of data will only provide more gist for optimism. To be sure, the link between household sentiment and behavior is not very tight. On the margins, however, perceptions matter and if a positive feedback loop gains traction it bodes well for the economy. Simply put, when people feel more secure in their jobs and income prospects, they tend to spend more than otherwise. If they also feel wealthier due to appreciating assets in their portfolios, that inclination is amplified. Case in point can be found in the third-quarter GDP as well as the September personal income and spending report released this week. Both revealed strong gains in household spending, and both confirmed that a good part of that strength reflected consumer willingness to draw down savings to fund purchases.

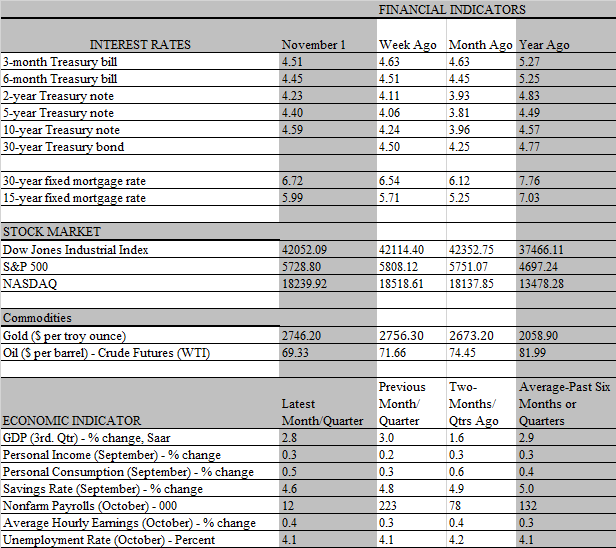

Of course, those reports depicted activity that was not overly distorted by the harsh weather conditions and the Boeing strike that battered swaths of the economy in October. The October jobs report provided the first evidence of the damage wrought by those shock-related events, and more will be forthcoming in the weeks ahead. Its unlikely that the skewed data will sway the Federal Reserve, which has been totally prepared for the data disruption and should keep its eye on the bigger picture. Still, the jobs report delivered a headline that was worse than expected, revealing a puny 12 thousand increase in nonfarm payrolls in October, much softer than the consensus expectation of a 100 thousand increase. If not for government hiring, the picture looks even bleaker, as private companies shed 28 thousand workers during the month.

The Labor Department could not accurately quantify the impact that two horrendous hurricanes had on the depressed payroll data, although it did note that the response rate to the survey of businesses and households was the lowest since 1991. Hence, its possible that some major revisions will show up when more complete information becomes available in subsequent reports. The toll taken by the Boeing strike, however, is more visible, accounting for 41 thousand of the 46 thousand plunge in manufacturing jobs during the month. The strike is ongoing, as union members rejected the latest proposal by management, so November payrolls may also be impacted unless the strike ends before the next BLS survey week. It is generally believed that Hurricanes Helene and Milton accounted for about 100 thousand job losses.

The good news is that the jobs lost due to the hurricanes will be recouped later in the year as rebuilding efforts take hold. Whats more, workers are holding on to their jobs, as the unemployment rate held steady at a low 4.1 percent. Although the unemployment rate, which is derived from a survey of households, is viewed as a less relevant measure of labor market health than the payroll survey, this time it may be giving a more accurate picture as it is not distorted by weather conditions. Workers who are forced to stay home because of bad weather are still counted as employed. That said, the fact that the unemployment rate stayed low last month had more to do with a reduced labor supply than reduced unemployment. The labor force shrank by 220 thousand in October and, while that may be a one-off, it is fair to speculate if the tightening of immigration policy is starting to have an effect.

If, as is likely, the pool of available workers is shrinking owing at least partly to a reduced influx of migrants, the breakeven pace of hiring to keep the unemployment rate steady would also be smaller. We expect job growth to slow but not enough to undermine GDP growth heading into 2025, which continues to ride considerable momentum. Not only is the economy coming off a sturdy 2.8 percent growth rate in the third quarter, but the period also ended with as much firepower as it began. Real personal consumption, the main driver of GDP, increased by a robust 0.4 percent in September, punctuating a 3.8 percent growth rate for the quarter. As noted earlier, households drew on savings to finance much of the spending increase, but the 0.4 percent decline in the savings rate during the quarter came off a relatively high level of 5.2 percent.

That said, personal savings is not a limitless source of funds for consumers. Real consumption has increased faster than real disposable income in four of the past five months and we expect the two sides of the ledger to become more aligned going forward. That portends some slowdown in spending since real disposable income grew by 1.6 percent in the third quarter. However, households do have some formidable tailwinds at their backs, which should keep them in a spending mood. Even with the expected moderation in wage growth, inflation is slowing at least as much, putting more purchasing power in the wallets of consumers. Meanwhile, the near-term outlook for the job market is buoyed by the increase in the demand for workers needed to facilitate the post-hurricane reconstruction efforts.

Importantly, with inflation continuing to cool, the Federal Reserve is expected to cut rates at least one more time this year and continue to do so throughout 2025. That, in turn, will provide critical relief to low-income households who have struggled to keep up with debt payments on credit cards and auto loans. This cohort has not benefited from the outsized gains on financial assets as have wealthier households who own the lions share of stocks and bonds. However, the wealth gain from surging home prices has been shared more equitably, so interest rate reductions heighten their ability to borrow against their inflated housing equity. However, most homeowners with mortgages have a rate of under 6 percent and will not benefit from refinancing unless mortgage rates decline much further than they have since the spring.

In fact, mortgage rates have increased since the Fed started its rate-cutting campaign in mid-September, with the 30-year rate sitting at 6.72 percent in the latest week. Thats lower than the 7.22 percent reached in May but well off the 6.09 percent low hit in late September. It is also a stark reminder that the Federal Reserve controls short-term rates but not long-term yields, which is determined by the markets. Despite the downbeat headline payroll data this week, traders still view the economy as resilient and are wary over a host of geopolitical and election uncertainties that could send oil and other commodity prices higher.