The Federal Reserve’s policy meeting took center stage amid a light data calendar this week. With no quarterly projections to mull over (the next Summary of Economic Projections will be released at the June 17-18 meeting) and no rate changes expected, the markets were laser focused on messaging, emanating from both the policy statement and, with more nuance, Chair Powel’s post-meeting press conference. Neither provided much in the way of surprises, but the presser, as usual, was animated by thoughtful questions that yielded insights into the Fed’s decision-making process.

The Fed’s decision to keep rates unchanged at the meeting required little explanation. Powell believes policy is in a good place, as it monitors the conflicting influences that tariffs have on Jobs and inflation. Importantly, he noted that the risks of both higher unemployment and higher inflation have increased, but they have not materialized yet in the hard data. Without supporting evidence that either side of the Fed’s dual mandate is breaking out, there is no compelling reason to move rates one way or the other. Powell acknowledges that tariffs will lead to price increases, but it’s unclear if they will be transitory or lasting. That said, with inflation remaining well above the Fed’s 2 percent target and the unemployment rate historically low, the case for the Fed to remain patient is strong. The incentive to cut rates will become more compelling when the job market shows visible signs of weakening. So far, that’s not the case even as the near-term threat to inflation has risen.

At the same time, Powell noted that the economy is healthy but shrouded in downbeat sentiment. This is an implicit recognition that the soft data is dismal and could at some point feed through to the hard data. Historically, however, this has not always been the case. Recall that households were persistently downbeat in the aftermath of the pandemic, yet the economy forged ahead. This is one reason the Fed may downplay the significance of households gloomy assessment of future job and income prospects. Alternatively, inflationary expectations do carry more weight in the Fed’s thinking, as there is more evidence that unanchored inflation expectations can become a self-fulfilling prophecy.

Unlike the downbeat assessment of economic prospects widely shared among households and businesses, there are mixed signals regarding inflationary expectations. Near-term expectations have skyrocketed, thanks mostly to tariffs, but the rise in longer-term expectations has been limited, albeit meaningful. Importantly, market-based inflation expectations, which the Fed closely monitors, have been remarkably contained. The 10-year breakeven rate has not broken out of the 2-2.5 percent range seen over the past three years, and the 5-year, 5-year forward rate, which tracks inflation expectations over the five years beginning five years from now, is markedly lower than it was at the start of the year.

That said, the Fed is also keenly aware of the supply disruptions that tariffs are already causing and were major contributors to the inflation spiral following the pandemic. Powell correctly noted that the Fed does not have the tools to subdue supply-related price increases without inducing a severe recession. Thanks to advance shipments of imports prior to the April 2 liberation day and inventory stockpiling by businesses, there is enough goods on hand to keep prices in check for a while. But shipments at U.S. ports are now dropping like a stone and as inventories are drawn down, price pressures will intensify. Unless trade deals are quickly negotiated and a healthy flow of goods to the U.S. is restored, product shortages will be far and wide by the fall. Not only would this intensify inflation, but it would force many outlets to close shop and lay off workers.

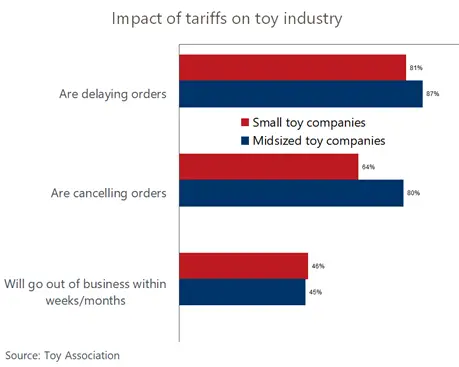

This is already sending tremors through the small business community that relies heavily on imports to carry out operations. The poster child for this linkage is the toy industry, where imports, particularly from China, account for the bulk of merchandise for sale. With the prospect of empty shelves looming, Christmas is looking extremely dour for shoppers. Indeed, the toy industry outlook couldn’t be grimmer, as nearly half of businesses in the sector expect to close their doors soon because of tariffs. No doubt, these mom-and-pop establishment will be closely monitoring events over the weekend, as trade officials from the U.S. and China are scheduled to meet.

Whether China is amenable to President Trump’s recent suggestion that 80 percent tariffs look about right compared to the current 145 percent remains to be seen; but the softer rhetoric by the U.S. is an encouraging sign that fruitful negotiations can take place. The relatively amiable agreement with the UK on tariffs secured this week is a positive sign, but most believe that this was low-hanging fruit for negotiators. The U.S. faces more testy challenges with the European Union, Japan and, notably, China. We expect that after the pause on reciprocal tariffs on July 9 is lifted, levies on China will remain elevated while other rates will be brought below the onerous levels announced on Liberation Day. Still, when the dust settles, the overall level of tariffs will be the highest in nearly a century.

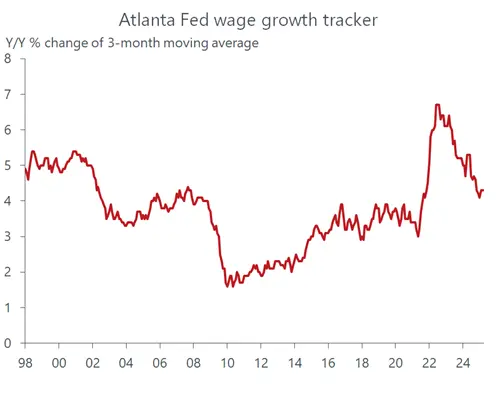

The good news is that while tariffs will still be a source of inflationary pressure over the foreseeable future, the job market will not. Wage growth has slowed markedly this year, with average hourly earnings retreating to below 4 percent, a pace fully in line with the Fed’s 2 percent inflation target, given stronger productivity growth. The Atlanta Federal Reserve Bank’s wage tracker confirmed that waning influence on inflation, as overall wage increases have held steady for the third consecutive month in April. From our lens, the tariff-induced lift to inflation over the near term will keep the Fed on the sidelines. But as tariffs take a greater toll on the economy later in the year, the Fed will shift its priority towards cushioning weaker job growth by resuming the rate cutting campaign, most likely by December.