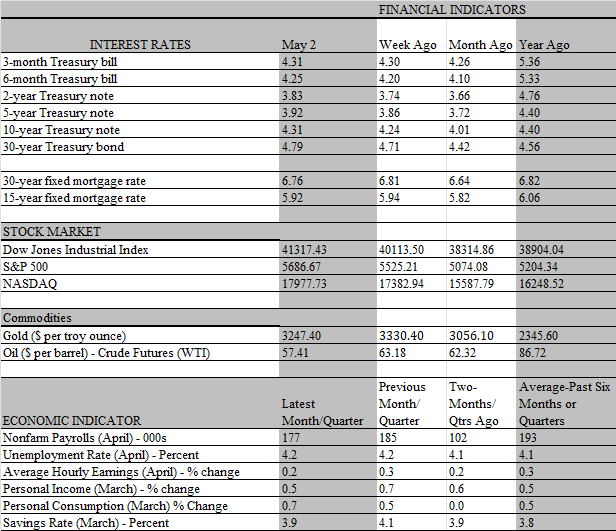

Despite ominous signs of a slumping economy, linked to tariff anxiety, the supporting evidence has yet to appear. True, the broadest measure of the economy’s overall performance in the first quarter suggests otherwise as GDP contracted for the first time in three years. But besides being backward looking that headline figure is also misleading as surging imports sliced almost 5 percentage points from the growth rate. Keep in mind that GDP measures the output of goods and services produced in the U.S. and imports are made overseas. Ordinarily, the negative impact from imports is offset by an increase in consumption of imported goods or by an increase in inventories. But it takes time for the imports to show up on the positive side of the ledger, indicating that an offsetting growth boost will show up in the second quarter.

Stripping out the trade and inventory influence reveals a stronger foundation, as final sales to domestic purchases increased by a solid 3.0 percent, which is actually a tad stronger than the 2.9 percent in the previous quarter. Simply put, the economy’s engine of growth, consumer and business investment spending, continued to forge ahead at a healthy pace. So, does that mean the economy is on a solid footing, with consumers and businesses plowing ahead despite the tariff distraction? Hardly. Indeed, the very strength of consumer spending in the first quarter reflects in good part the front running of purchases before the attention-grabbing tariff hikes kick in. That was particularly the case for big-ticket items, such as autos, which spiked in March. The same is the case for business spending, where the rush to import equipment ahead of tariffs also contributed to stronger spending.

All this will lead to a hangover over the spring and summer months, when the toll from tariffs will become more evident. Just how much damage will occur is up in the air, partly because of the uncertainty over the magnitude and scope of tariffs that will be in place. The pause on most of the liberation day tariffs announced on April 2 will extend until July 2, so there is still time for more negotiation and adjustments that could soften the blow. But the levies already imposed leaves the tariff rate at historically high levels, and further punitive increases are likely to come. That prospect is already slowing goods in the pipeline as cargo being shipped to the U.S. from overseas is dropping like a stone, portending severe shortages of a swath of goods in coming months. A scarcity of Christmas toys, much of which comes from China, is poised to upset millions of children over the holiday season, and those available will cost a lot more than in previous years, upsetting parents.

Needless to say, all eyes are fixated on post-liberation day data that would inform us about the impact tariffs are having on the economy. Unfortunately, it’s still too soon to arrive at firm judgements. Pessimists are waiting for the hard data to catch up with the grim soft data, including plunging household and business sentiment, while optimists are still gloating over the solid performance revealed in the hard data. At this juncture, the optimists have the upper hand, as the most current hard data continue to portray a healthy economy. That includes the noisy GDP report, where, as noted earlier, the underlying details reveal more strength than the headline contraction in the first quarter.

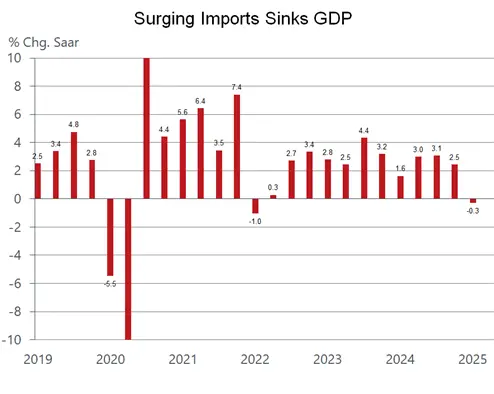

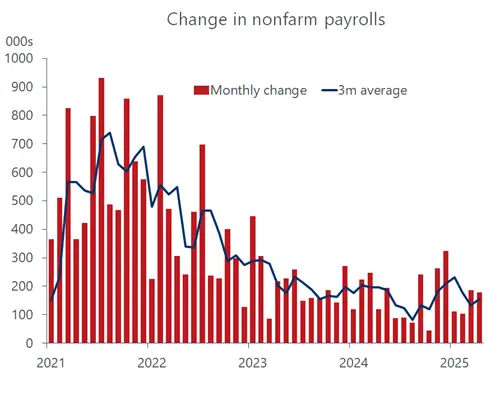

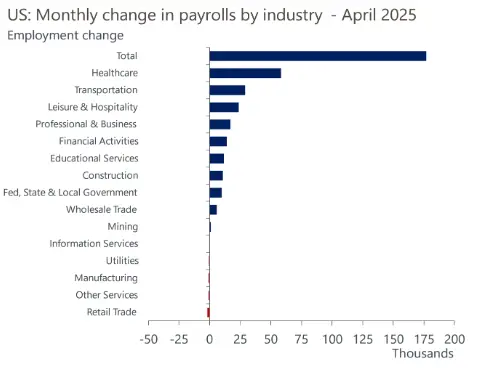

The all-important employment report for April, released on Friday, does not change the narrative. On the surface, the job market is continuing to chug along, shrugging off any negative impulse from tariffs. Nonfarm payrolls increased by a sturdy 177 thousand in April, comfortably exceeding consensus expectations of a roundly 130 thousand gain. The previous two months’ tally was revised lower, but the trend remained firm, as the increase over the last three months averaged 155 thousand, up from 133 thousand in March and almost spot-on with the 152 thousand increase over the previous 12 months. Meanwhile, the unemployment rate remained historically low, holding at the same 4.2 percent as in March, and the share of adults participating in the labor force remained high, inching up to 65.6 percent from 65.5 percent in March. Among the prime-age cohort, 25-54, the participation rate came in even stronger, rising from 83.3% to 83.6%, an 8-month high. Trade concerns are not spurring workers to exit the labor force.

But there are caveats to the jobs report that raise yellow flags. For one, the Labor Department counts workers receiving paychecks during the week of April 12. That’s less than two weeks from the April 2 Liberation Day tariffs, and barely enough time for businesses to adjust or understand what the consequences might be. Keep in mind also that about three-quarters of all workers are paid on a biweekly or monthly basis. Hence, some may have been unemployed but still counted as employed because they received a paycheck.

That notion is particularly relevant for government workers, where jobs fell for the third consecutive month in March although the losses so far, including the 9000 in March, are far less than the purge sought by Elon Musk’s DOGE team. However, we expect federal job losses to accelerate in the months ahead. Court actions required about 24,000 terminated probationary workers to be rehired, but we think reprieves for many workers will be temporary. Also, a process for terminating non-probationary workers got underway in mid-March; generally, federal workers are required to get 60 days’ notice before they are let go, which suggests we are likely to see federal layoffs ramp up either this month or in June. In total, we estimate that there will be 200 thousand federal job losses in 2025, including 75,000 who accepted the administration’s deferred resignation offer.

What’s more, as is the case with household and businesses front-loading purchases to beat tariff hikes, at least one sector is doing the same with its staffing decisions. The warehousing and transportation sector is heavily influenced by import trends, as truckers are needed to transport goods from ports and workers are needed to stock up warehouses with the goods when they arrive. Hence, the greater the imports, the greater the need for workers, and the surge in imports in March understandably stoked a corresponding surge in jobs last month. The transportation and warehousing sector added 29 thousand jobs in April, more than double the average of the past three months. With imports from China now at a standstill because of tariffs, we expect jobs in this sector to fall accordingly. Indeed, the Labor Department reported that job openings fell by 17 percent in March in its Job Openings and Labor Turnover survey.

From our lens, the hit from tariffs lies ahead, and we expect job growth to slow and the unemployment rate to rise beginning this summer. Employers are not ready to purge their workforce for several reasons. For one, they are understandably taking a wait-and-see attitude as tariff policy is unfolding in a chaotic manner, seemingly changing from week to week. Heightened uncertainty contributes more to inertia than decisive action. For another, employers remember how difficult it was to rehire workers laid off during the pandemic, leading to an extended period of labor shortages and steep wage increases in the post-pandemic recovery. The cut to the labor supply from restrictive immigration policies reinforces fears that fewer workers would be available to rehire. That said, while companies are holding on to their workers, they are also putting hiring on hold, making it harder for unemployed workers to find a job. That is contributing to rising expectations of weakening labor conditions in household surveys and will lead to a slowdown in consumer spending in the coming months.