The soft-landing narrative is once again in the forefront, as most economic reports are coming in softer than expected and inflation continues to cool. Last week’s headlines featured the soft inflation data; this week the spotlight shone on the growth drivers consumers, jobs and housing. To be sure, not all sectors are fraying at the edges. Manufacturing activity staged a notable increase in May, paced by a rebound in auto output and supported by the ongoing frenzy over AI technology. The latter is spurring stronger demand for electrical equipment, such as switchers and transformers, whose production has surged over the past year. That said, the pop in production last month comes on the heels of weak activity earlier in the year and is not likely to be sustained in coming months. Banks are tightening credit, high interest rates are crimping investment activity and consumer demand for goods is weakening.

Put another way, the central bank’s inflation fighting campaign is slowly but surely having its expected effect on the broader economy. The transmission of elevated interest rates to the economy is taking longer to play out as a broad swath of households and businesses have locked in the lower rates that prevailed before the Fed started pumping the monetary brakes. What’s more, household balance sheets continue to benefit from appreciating stock and home values, and that wealth effect is stoking more demand than otherwise. But those tailwinds are mostly benefiting wealthier households, whose bloated stock portfolios and housing equity encourage them to save less out of incomes and spend more on goods and services. Unsurprisingly, cruise ships are seeing record bookings, luxury hotels have few vacancies, fans are flocking to concerts and sporting events and discretionary spending on experiences in general is booming.

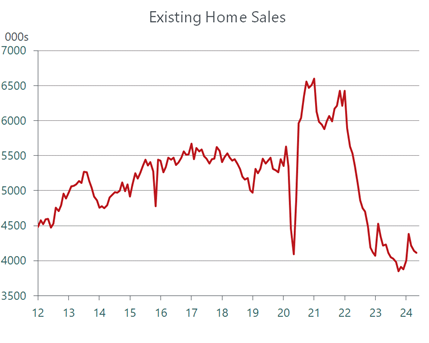

However, the less wealthy segment of households is feeling the pain of high interest rates. Not only do they have less of a savings cushion to fall back on, higher prices on essentials – housing, utilities and groceries – that comprise a large fraction of lower -income budgets have forced them to step up borrowing to support living standards. The surge in interest rates on credit cards and auto loans reinforce the squeeze on their household finances, resulting in climbing delinquency rates, and crimping spending behavior. While spending by lower income consumers is outweighed by those higher up the income ladder, their pullback is taking an ever-bigger toll on overall outlays. That drag is becoming more noticeable and hit with a louder thud on retail sales last month, which came in weaker than expected.

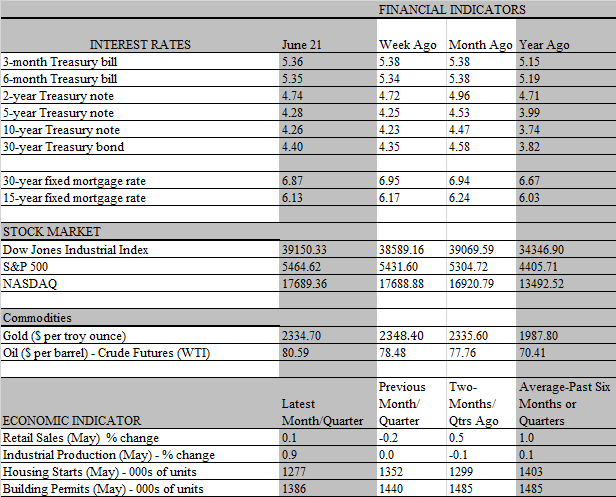

Overall sales barely increased in May, inching up by 0.1 percent, following a downward revision the previous month, which now shows a drop of 0.2 percent instead of the previous estimate of no change. Clearly, consumer spending is losing some momentum. That said, the headline figure overstates the pullback because prices for goods have been declining and retail sales, which are mostly for goods purchases, are recorded in nominal dollars. A major drag on sales last month, for example, was for gasoline purchases, as sales at service stations declined by 2.2 percent, the largest decline in six months, reflecting a sharp drop in prices at the pump. Take out gasoline purchases, and the overall sales figure looks more respectable, rising by 0.4 percent.

Hence, it would be a mistake to say that consumers are going into hibernation. Lower prices on goods are dragging down current sales, but it also boosts purchasing power. Economists have long viewed a decline in gas prices as the equivalent of a tax cut, leaving households with more funds to purchase other goods and services. According to the May CPI report, goods prices fell 0.4 percent last month, which indicates that real purchases of goods increased by nearly half-percent during the period. Still, the downward revisions in retail sales over the previous two months points to a modestly slower growth in real personal consumption during the second quarter compared to the first.

We will have a better reading on overall consumer spending for May, including outlays on services, next week, when the personal income and spending report is released. However, spending at restaurants and bars, the one service sector included in the retail sales report, does send a cautionary signal, as it recorded an unexpected 0.4 decline, erasing the previous month’s increase. It was the second decline in this key discretionary spending category in the last three months, suggesting that even wealthier consumers are showing some fatigue. Importantly, the strain from elevated interest rates made its presence felt, as housing-related categories of spending continued to decline in May. Building material sales declined by 0.8 percent and furniture store sales fell by 1.1 percent. Spending in both categories is down sharply from a year ago.

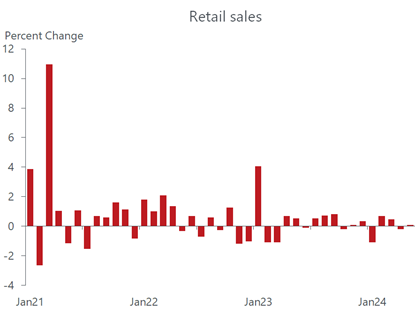

Not surprisingly, the weakness in housing-related purchases is directly linked to the ongoing slump in the housing market, where sky-high mortgage rates and surging home prices are clobbering sales and home construction. Sales of previously-owned homes slipped another 0.7 percent in May and are down 3 percent from a year ago. The good news is that mortgage rates have declined by almost a half-percent from its peak hit in early May. The bad news is that median home prices hit a new record last month, reaching $419,300, so housing affordability is becoming more of a problem for would-be home buyers, particularly those entering the market for the first time. The lack of supply is contributing to the climb in home prices and while the number of homes for sale did increase a tad last month, lifting inventories to 3.7 months of sales, a balanced market would be one that featured a 6-month supply. So there remains a considerable shortage of homes on the market. Meanwhile, builders are not filling the void, as construction started on new homes fell to a 4-year low in May.

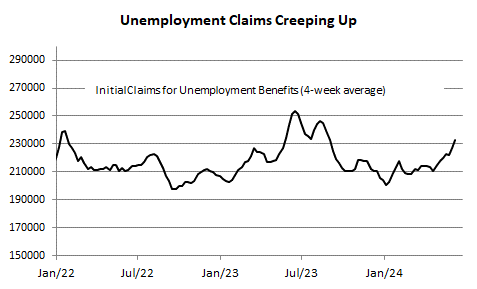

Clearly, the weakness in housing activity will not bring down the economy, as residential construction accounts for less than 4 percent of GDP. True, a big chunk of consumer spending is directly or indirectly linked to the housing market and, as we have seen in the retail sales report, the impact of housing weakness can be meaningful. But the biggest influence on household spending is jobs and income, and both are still growing at a sturdy, but slowing pace. What’s more, the slowing is unfolding in the right way, just what the Fed wants as it pursues a soft landing for the economy. Employers are cutting back hiring, not resorting to massive layoffs to curtail labor costs. Job openings have fallen sharply in recent months and are back to about where they were just prior to the pandemic. True, there are early signs that layoffs are rising. Initial claims for unemployment benefits are creeping up, as would be expected in a softer job market. But the level of claims is still consistent with modest job growth, and we expect nonfarm payrolls to stage a slower but still respectable increase in June in the upcoming monthly employment report. Importantly, the softer job market is curtailing wage demands, a crucial element in curbing inflation. We believe the stage is being set for the Fed to start cutting rates in late summer or early fall. Indeed, if it waits too long, the risk is that it will lose the opportunity to see a soft landing and will shift its priority to fighting a recession.