The Labor Department delivered a triple-crown winner on the inflation front this week, as a surprisingly benign CPI report boosted the fortunes of consumers, workers, and policy makers. Whether the Biden administration will reap the benefits is uncertain, depending on how long it takes for current good news to eclipse years of pain in the minds of voters. Still, there is time for the White House to claim at least some bragging rights as three more inflation reports will capture headlines before the November 5 election. One caveat even if nerves are soothed by more favorable inflation data. If the slower price gains come at the cost of large job losses, the tradeoff may not sit well with the electorate.

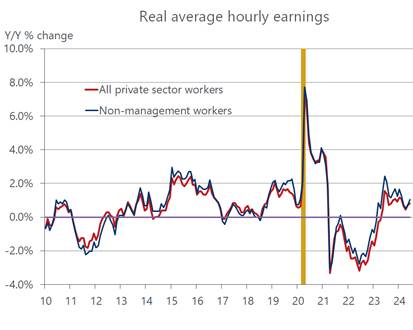

That’s where the rubber meets the road for the Federal Reserve. Clearly, the Fed is pleased with the June reading on inflation, which revealed a better-than-expected 0.1 percent drop in overall consumer prices and a tiny 0.1 percent increase in the core CPI, which excludes volatile food and energy prices. These are the tamest outcomes in more than three years, and the steepest drop in the headline CPI since the depth of the pandemic recession in February 2020. The good news for the Fed is that the inflation retreat is occurring amidst minimal collateral damage to the job market. The bad news is that labor conditions are in the initial stage of weakening which, historically, has been difficult to curb once the trend gains traction.

To its credit, the Fed is aware of the rebalancing of risks that is taking place. Until recently, policymakers focused primarily on stifling inflation, as the economy hovered near full employment and rising labor costs threatened to keep a fire under prices. But with three months of slowing inflation and three months of rising unemployment on the books, the Fed has recalibrated its priorities. As highlighted by Fed chair Powell in his congressional testimony on monetary policy this week, the risk of recession now looms as large as the risk of higher inflation. Powell has still not set a date, but his comments strongly suggested that rate cuts will soon be needed to keep the economy afloat and guide it to the heralded soft landing. Some commentators have even put the July 30-31 policy meeting on the table, but traders and most economists are coalescing around September as the likely launch date for the first reduction, which aligns with our forecast.

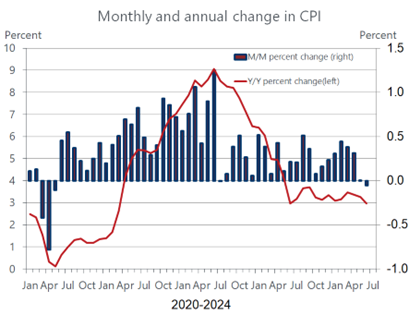

While the Fed represents one leg of the triple crown, seeing the prospect of a soft landing enhanced by the inflation retreat, workers and consumers have also entered the winner’s circle. Worker paychecks are going a longer way, as real average hourly earnings staged the strongest increase in four months in June. Importantly, the gain is occurring for the right reason in the eyes of the Fed. Wage growth is slowing, an organic response to a softer job market, but price gains are slowing even more, thanks in large part to the Fed’s efforts. What’s more, the real gains for blue-collar workers are outpacing those for management, providing critical support for low-wage earners struggling to meet payments on credit card debt.

Meanwhile, consumers are finally getting relief on a wide range of products that have taken an ever-heavier toll on budgets. True, the 3.8 percent plunge in gasoline prices contributed mightily to the outright decline in the headline CPI last month. But prices at the pump are fickle and they seem to be poised for a rebound this month. The same is true for food prices, although food purchased for home use (as opposed to eating out) has declined in four of the past five months, pointing to a more durable trend as households have become more selective in their buying habits at supermarkets. Moreover, price increases have cooled on a wide range of items, including apparel, physician fees and hospital services while airline fares fell last month and car dealers cut prices on new and used vehicles. In short, households, like workers, are enjoying a boost in real disposable incomes, which should provide critical support for spending in coming months.

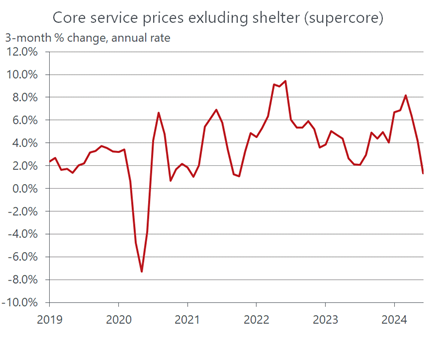

Importantly, shelter costs – the biggest expense item for most households – are showing signs of cooling, as the weakening trend in market rents seen over the past several months is finally seeping into the official price data. Overall shelter costs inched up by only 0.2 percent in June, the smallest rise since August 2021 and less than half the average increase over the previous three months. The sharp monthly decline probably overstates current conditions in the housing market, but the long-awaited break in shelter costs seems to be finally taking hold. Even so, the Fed acknowledges that it has little influence over rents and has been closely monitoring core service prices excluding housing for some time. The recent behavior of this so-called supercore index has been even more encouraging, as it posted back-to-back declines in June for the first time since August/September of 2021.

Indeed, over the past three months the supercore index has increased at an annual rate of 1.31 percent while the broader core CPI has increased by 2.0 percent. which several commentators regard as evidence that the Fed has already reached its 2 percent target. That sentiment, of course, bolsters the notion that the Fed should start cutting rates sooner rather than later, providing fuel for those who believe a cut as soon as July 31 is warranted. That notion, however, is not likely to gain broad support among policy makers as long as the job market continues to generate sturdy payroll gains, reducing the risk that the economy is poised to fall off a cliff.

No doubt, the Fed is gaining more confidence that inflation is on a sustainable path towards the 2 percent target; but it will likely want to see a few more months of disinflation before pulling the trigger on the first rate cut. Significantly, the downward trend on an annual basis will be meeting more resistance in coming months because inflation was falling rapidly over the second half of last year. The base effects will make the year-over-year comparisons look less favorable. Hence, the Fed will pay closer attention to the sequential monthly changes. If the core CPI registers a string of 0.1-0.2 percent monthly increases over the remainder of the summer, as was the case the last two months, we believe the Fed would have enough confirmation to start cutting rates at the September meeting.