If Benjamin Franklin was alive and able to amend his most popular quote, he might add uncertainty to death and taxes as the only sure events in life. Admittedly, we believed that the arrival of the new year would see a taming of the headline-grabbing uncertainty that buffeted the economy and financial markets in 2025, not to mention the mindset of households and businesses. But hopes for a more tranquil economic backdrop this year have been seriously tested by events in recent weeks. Geopolitical tensions (Venezuela, Iran and Greenland) continue to flare and tariff threats have hardly receded into the background. Unsurprisingly, market volatility returned with a vengeance, stoking wide swings in stock and bond prices. These market swings, however, seem to be serving a vital purpose, sending a signal to authorities that bad decisions have consequences.

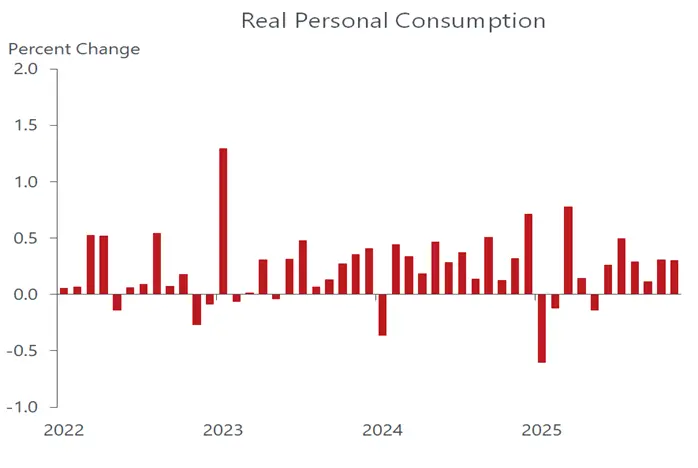

But while the turmoil has clearly undercut household and business sentiment, it has yet to inflict serious pain on the economy. Consumers in the aggregate are still spending, and companies are still investing profusely on Ai-related technology, notably on data centers and R&D. And despite the wide swings, stock prices continue to forge ahead this month, posting a net gain since year-end. Perhaps the most visible negative consequence of the ongoing uncertainty is that it has frozen hiring plans, resulting in a widening pool of frustrated job seekers, including college educated, white-collar workers. But layoffs remain low as companies are holding on to staff as long as sales and revenue prospects do not deteriorate. Over the near term, those prospects are looking favorable, as the spending stream is poised to receive a formidable injection of purchasing power from the tax refunds and breaks derived from last year’s One Big Beautiful Tax Act.

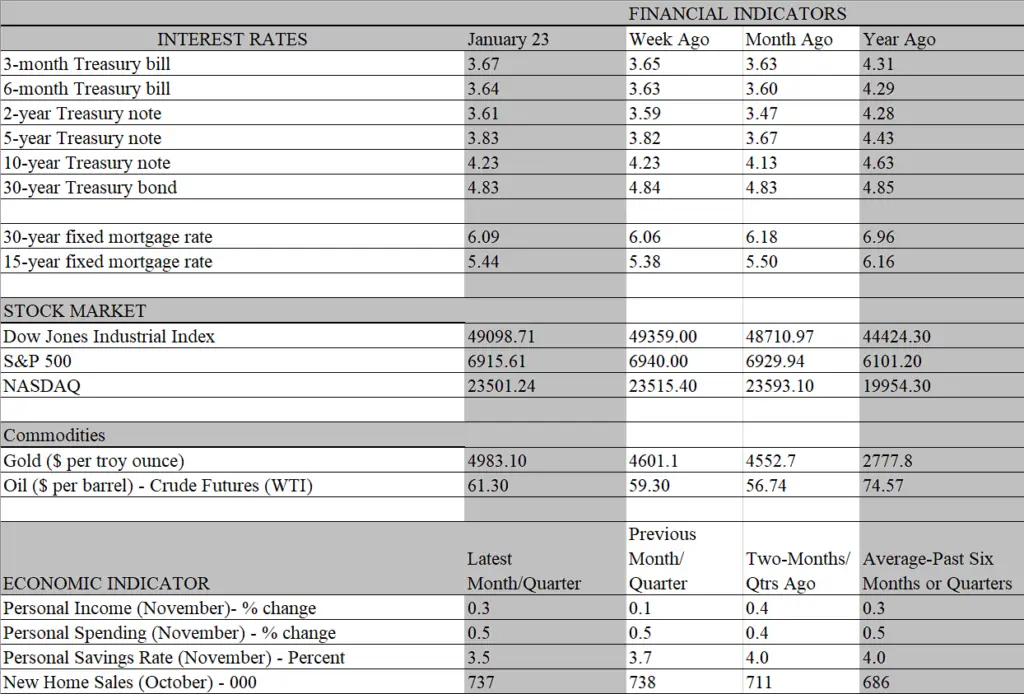

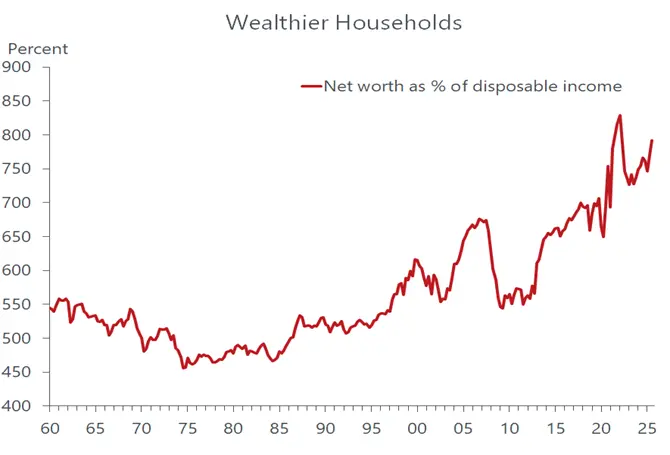

We expect that the tax windfall will impart vigor to consumer spending over the first half of the year, sustaining the above-trend growth in GDP. As has been the case in recent years, the biggest thrust in consumer spending will come from older and wealthier households who are sitting on a cushion of financial assets that has been greatly inflated by surging stock prices. In the third quarter, household net worth increased by $6 trillion following a $7.2 trillion gain in the second quarter, thanks mainly to surging stock portfolios. Federal Reserve data reveal how concentrated this wealth has become, as the top 10 percent of the richest households hold nearly 70 percent of all wealth.

The wealthier people become, the more emboldened they are to save less out of income, as financial security is strengthened by their appreciated asset holdings. Historically, when net worth increases faster than disposable income, the savings rate has fallen. That pattern was on full display late last year, as consumers tapped deeply into savings to finance purchases. The personal savings rate in November fell to 3.5 percent, the lowest in more than three years. Just as the three-year stock market boom was getting its legs in March 2023, the savings rate stood at 6.0 percent. In the third quarter, households drew on savings to finance nearly 60 percent of the $321 billion increase in consumption, the largest share since the first quarter of 2022.

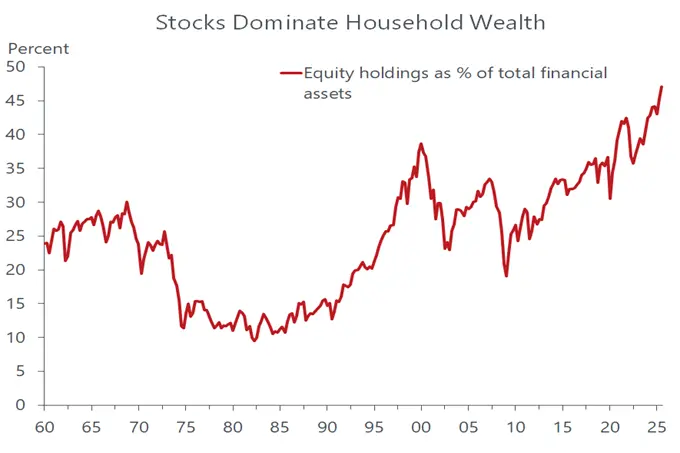

It is not far-fetched to think that a major setback in stocks – the main driver of wealth in recent years – would spur households, even affluent ones, to rebuild savings, putting a dent in spending. The vulnerability of household portfolios has never been higher, as stock holdings account for a record 47 percent household financial assets, up from 36 percent three years ago. While it’s true that the stock market is not the economy, there is no question that it can have a significant impact. That said, history shows that it is a fool’s game to predict the stock market, particularly amid heightened uncertainty linked to external events, which as we have seen so far this year has not been tamed.

With consumers continuing to flex their spending muscles in October and November, the economy is on track for another solid growth in GDP in the fourth quarter. Incoming data, which is still sketchy due to the government shutdown, is tracking a pace of over 5 percent, which would dwarf the above-trend 4.4 percent growth rate in the third quarter. Odds are likely that more complete data as well as reports for December will take a slice out of that growth prospect but still portray a healthy performance for the economy to close out the year. That said, there are cautionary signs in the latest report on personal income and spending that suggest momentum from last year may not be sustainable.

Most important is that the solid increase in consumer spending in October and November was again financed with savings. While personal income did increase by a respectable 0.3 percent in November, that followed a slim 0.1 percent increase in October. Worse, all of the income gain over the two months was eaten up by higher prices and taxes. Real disposable income showed no gain over the two months, as the 0.1 percent November increase offset a 0.1 percent decline in October. With the savings rate already historically low, the income side of the ledger will need more support to keep households in a spending mood. While wealthy households may or may not derive more purchasing power from a fickle stock market, lower- and middle-income households rely heavily on income growth to sustain spending.

The good news is that help is on the way for the broadest segment of the population as the aforementioned tax refunds hit bank accounts. While the biggest impact on spending is likely to occur during the spring tax filing season, we suspect that lower income households will file earlier to obtain the funds as soon as possible. That will become even more urgent as healthcare costs are poised to jump for millions of Americans due to the expiration of subsidies. Another boost for the lower-income cohort is the increase in minimum wages that took place in 19 states on January 1, boosting paychecks for 8.3 million workers.

Ultimately, the biggest source of income is the job market, which continues to generate enough paychecks to sustain a decent pace of spending. But wage growth is slowing even as inflation remains sticky, a combination that exerts steady pressure on real incomes. For now, the Federal Reserve is focused more on the inflation side of its dual mandate, as the job market is holding up. From our lens, real incomes will get an increasing boost later this year as inflation resumes its downward trend. As that trend takes hold, the Fed can shift its focus towards supporting the job market, resuming its rate-cutting campaign. But that shift may not happen before mid-year, unless some external event – like another bout of extreme uncertainty – knocks the economy off the rails.