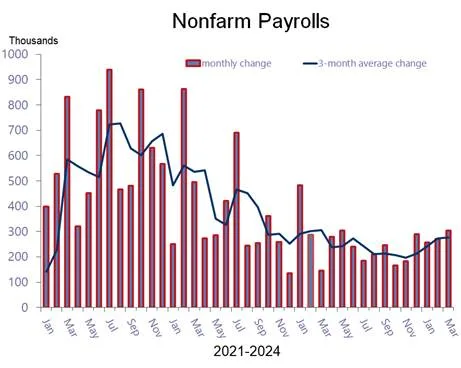

They did it again. In what’s become a distressingly common occurrence, the Labor Department

revealed another upside surprise on the jobs front, revealing that the economy created an eyeopening 303 thousand net new jobs in March, far above the consensus forecast of roundly a 200

thousand gain. True, revised figures cut 5 thousand jobs from the previous estimate for February, but

that was more than offset by a 27 thousand upward revision to the January payroll increase. One

month can be very noisy, but three months of data represent more of a realistic trend. Taking this

broader view, the economy generated an average increase of 276 thousand payrolls over the past

three months, up from 246 thousand in January and the strongest for a three-month period in a year.

Simply put, the job market is still chugging along, generating far more jobs than the assumed increase

in the working age population. In another sign of a tightening labor conditions, the unemployment

rate slipped back to 3.8 percent after leaping 0.2 percent point to 3.9 percent in February. The

question is, is the job market too hot to handle, stoking higher inflation and a more vigorous response

from the Fed?

On the surface, the simple answer would seem to be, yes. After all, companies are consistently hiring more workers than expected month after month, the jobless rate has slayed below the historically low level of 4 percent for more than two years, and inflation is taking far too long to recede towards the

Fed’s 2 percent target. What’s more, the skeptics who thought the payroll numbers overstated the strength in job growth because a companion survey of households by the Labor Department – which determines the unemployment rate – has been coming in much weaker, have also been sidelined. In

March, the household survey showed an even stronger increase in employment – 498 thousand – than the establishment survey, which generates the payroll numbers.

These conditions would ordinarily catalyze the Federal Reserve into a more aggressive inflation-fighting mode, pivoting away

from its recent pivot towards a more relaxed policy stance that pointed to three rate cuts this year.

But these are not ordinary times, and a different perspective is clearly needed to judge the inflationary consequences of the ongoing strength in the jobs reports. Indeed, neither the financial

markets nor Fed officials seem especially perturbed by the incoming data. Stock prices roared ahead on Friday, following the employment release, and yields in the inflation-sensitive bond market hardly moved. The 10-year Treasury yield edged up slightly to 4.40 percent but that’s about where it has

been for much of the past several weeks and off the nearby peak of 4.43 percent. It’s important to remember that strong job growth by itself, would not provoke the Fed into a tightening move as long as it does not stoke higher inflation or increase inflation expectations. Chair Powell has repeatedly reminded investors that inflation receded markedly last year amidst persistent above-trend job growth.

To be sure, policy makers have been signaling for weeks that there is no rush to cut rates, despite widespread urging to do so until recently, as the economy is holding up and seems well equipped to withstand the current level of rates for a while longer. If nothing else, the continued sturdy performance of the job market confirms that sentiment, which is now accepted by virtually all Fed

officials. A plethora of speeches by Fed officials over the past two weeks struck a more hawkish tone than was the case a month or so ago, when the inclination to cut rates appeared to be much stronger among policymakers. We still think that the bias is to reduce rates later this year, but keeping them higher for longer now seems to be the consensus at the Fed. We agree with that delay and see the first rate cut likely coming in the summer rather than the spring, as earlier thought. Importantly, it’s unlikely that the delay will make much of a difference in the economic outlook. Nor would that be the case if the number of rate cuts were trimmed from 3 to 2, which may very well be the case this year.

Keep in mind that the underlying reason the Fed is likely to cut rates is not to prevent a recession, which is increasingly unlikely in the foreseeable future, but to normalize monetary policy. There is a growing acceptance of the notion that the central bank sees the need for “maintenance” cutting.

Simply put, if the Fed does nothing as inflation continues to recede, it would in effect be making borrowing more expensive, as real, or inflation-adjusted rates would thereby increase. That’s precisely what has been unfolding since last July, when the policy rate was pegged at its current level.

But since then, inflation as measured by the core consumer price index has fallen on a year-over-year basis from 4.7 percent to 3.8 percent. Hence, the real interest rate has increased by almost a full percentage point over the period, which Fed chair Powell acknowledges puts it in restrictive territory. So far, that has not had much of negative impact on the broader economy, although the rate-sensitive sectors, most notably housing and auto sales, have taken a hit.

We suspect, however, that the bite from high rates, if they remain unchanged, will take a bigger toll on the economy if inflation continues to recede, which is expected in coming months. In fact, despite another blockbuster month of job growth, the inflation side of the employment report does not suggest that businesses are coming under greater pressure to raise prices – at least from higher labor costs. As we have noted in recent commentaries, the acceleration in wage growth in January and February was more noise than substance, reflecting harsh weather conditions, minimum wage hikes

and one-time increases from labor contracts negotiated late last year.

Hence, after a torrid start, average hourly earnings calmed down in March, rising by a more trend-like 0.3 percent for all workers and by an even tamer 0.2 percent for non management workers. On a year-over-year basis, earnings have increased at the slowest pace – 4.1 percent – since June 2021.

Can this slowing trend continue, even as hiring remains as hot as it has? The jury is still out on this question, but there is reason for optimism. For one, inflation expectations remain well anchored – and may actually be retreating according to some recent surveys. If workers expect the Fed to stay adamant about reducing inflation to 2 percent, they will feel less urgency to bargain for bigger wage

increases. A critical wild card is the recent spike in gasoline prices, which along with groceries, is the most visible sign of price trends that could upend inflation expectations even if prices on the broader basket of goods and services increase more slowly. Unfortunately, Fed policy has little control over gasoline prices, which are mostly influenced by external forces, such as OPEC output quotas or shortages caused by geopolitical conflicts, such as the war in Ukraine.

For another, there are signs of loosening labor market conditions despite the low unemployment rate. The ideal path to a soft landing in the eyes of the Fed is for businesses to cut back hiring instead of massively laying off workers, which would surely usher in a recession. That seems to be direction the job market is taking, as businesses have been posting fewer job openings in recent months. What’s more, workers have been staying on the job longer, as the voluntary quit rate has declined to prepandemic levels. The quit rate compiled by the Labor Department, is a time-honored leading indicator of wage trends, pointing to slower wage gains later in the year. The wage premium for switching jobs has also been shrinking, providing less incentive to jump ship.

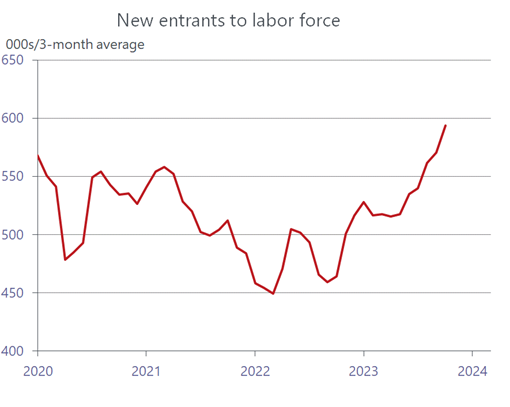

Finally, the strength in job growth would be more worrying if the pool of labor could not accommodate the demand for workers. That is clearly not the case. The jobs are readily being filled by

workers coming from a wide variety of places and demographics, including younger, older, and foreign workers. The labor force expanded by an outsized 469 thousand in March, boosted in part by immigration, and the labor force participation rate increased from 62.5 percent to 62.7 percent. A

striking detail tells it all: new entrants to the labor force are surging. In March, they staged the biggest increase since November 2017. As long as the supply of labor continues to expand, the economy can accommodate more job growth than has historically been the case. The Fed, in turn, is hoping that

increased supply, both of labor and productivity-enhanced production of goods, can spur growth without leading to a reacceleration in inflation.