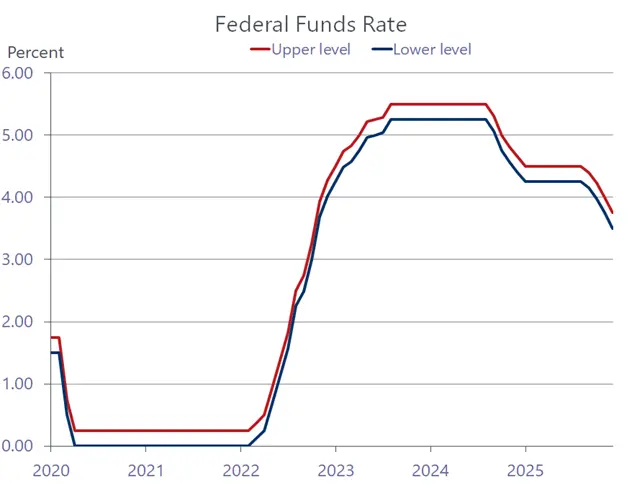

The Fed followed the expected script this week, cutting rates by another quarter-percentage point, the third consecutive cut since September. If there was any drama at the gathering, it concerned the dissenters, among which were three. While that’s a lot historically, there was more of a consensus than thought, as the whisper speculation suggested as many as five policymakers would vote against the quarter pointer. The biggest surprise was that only one voted for a larger cut. Some thought that a greater number would vote for a more aggressive easing move based on recent dovish comments by several officials,

No matter. The markets reacted joyously, sending stock prices up and yields down the day following Wednesday’s meeting and Chair Powell’s press conference, although the gains were erased on Friday. The Fed’s policy rate now stands at 3.-50%-3.75%, which is closer to the Fed’s perceived “neutral” rate of 3.0 percent than inflation is to the 2.0 percent target. According to the latest Summary of Economic Projections released at the meeting, neither target is expected to be reached next year, but that Goldilocks landing should be within reach in 2027. But as we have seen with previous Fed projections and the economy’s actual performance, there is always a slip between the cup and the lip.

Although the inflation gap relative to its target is wider than the federal funds gap, the Fed is still more worried about the risk of a deteriorating job market than of worsening inflation. That risk assessment, which underscored the Fed’s decision to cut, is not surprising. Policymakers believe that they are better equipped to reverse an inflation pickup than they are to arrest a slumping job market once it gains traction. Keep in mind too that the Fed puts more importance on the direction of inflation than it is in hitting the target. If inflationary pressures are easing and core inflation is moving sustainably in the right direction, i.e., towards the 2 percent target, it is more comfortable easing up on the monetary brakes.

At this juncture, key inflation gauges are sticky but inflationary pressures are relatively dormant. The main impulse propping up inflation is tariffs. But most of the tariff impact is behind us and should be mostly in the rear-view mirror after the first quarter of next year. Importantly, inflationary expectations, which the Fed monitors closely, continue to be well anchored, even as households complain vociferously about high prices. That’s more of a political issue than a problem the Fed can solve, as high prices reflect an accumulation of past events. The Fed can only control how fast prices rise going forward.

However, when it comes to the job market, the Fed is on shakier footing. While it has a relatively clear idea of where inflation stands and where it is heading, labor conditions are shrouded in a foggy mix of conflicting data. The no hire/no fire narrative captures the widely accepted perception of the job market, but that label itself signifies the tenuous nature of conditions. For one, it describes a static environment, which says nothing about where the trend is heading. It also suggests that a shock of any kind can have an outsized influence on business decisions to step on either the hire or fire side of the staffing ledger.

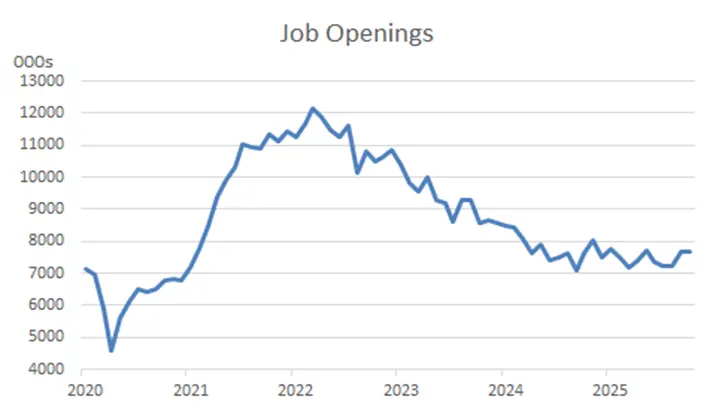

The data on hand provides little clarity on the issue. The Jobs Opening and Labor Turnover survey (JOLTs) released this week revealed a hiring rate in October that is languishing at the lowest level in more than a decade, matching the low point seen during the pandemic. The data also show that employers are holding on to their workers as the layoff rate, while a notch higher than in August, has remained steady in five of the past seven months. That echoes the theme at state unemployment offices, where initial claims for jobless benefits are only grudgingly edging up from historical lows, despite headline-grabbing layoff announcements from some high-profile companies. But vibes among workers remain bleak, as the voluntary quits rate continue to grind lower, hitting the lowest level since the pandemic. Prior to that, you would have to go back to 2014 to find another time when workers were clinging as dearly to the jobs, facing unwelcoming prospects elsewhere.

To be sure, the absence of up-to-date official payroll data due to the recent government shutdown doesn’t help the Fed’s quest to get a fuller understanding of labor conditions. While the data will be coming onstream in coming weeks, doubts about their reliability will remain high for a while, as it will take time for the collection process to be fully up and running. We expect that jobs will continue to grow in 2026, but not as strongly as the economy, fueled by improved productivity. Given the supply restraints on the labor supply from the immigration crackdown, the productivity-enhanced growth engine is a highly welcome development, as fewer workers will be needed to generate output

We estimate that only about 30 thousand payroll additions per month will be needed to keep the unemployment rate from rising next year. But we also caution that the supply constraints on labor works both ways. While it helps keep the unemployment rate down, it also siphons off slack in the labor force. So, if the demand for workers turns out to be greater than expected the pressure on wages would also intensify and heighten the risk of higher inflation. We note that a good deal of fiscal stimulus will be entering the spending stream in coming months, thanks mainly to a flood of tax refunds associated with OBBA passed last summer. That prospect may help explain the outlier in the JOLTS report. While hiring remained week, job openings leaped to 7.7 million in October from 7.2 million in August. This may indicate that employers are preparing for stronger sales over the winter. But it also is another unknown that could complicate the Fed’s policy decision down the road.