All eyes will be laser-focused on next weeks jobs report, the key monthly data print that is the primary mover of markets and perceptions about the health of the economy. Unfortunately, the report will be marred by external shocks hurricanes and a Boeing strike that will obscure the true strength or weakness in underlying fundamentals. Sharp-eyed analysts will look through the distortions and find relevant details that give a more accurate picture of emerging trends. But the headlines always supersede the minutia, so it�s best to prepare for some volatile trading following the report.

That said, the Federal Reserve, whose rate-setting committee meets just five days following the jobs report, will keep its eye on the bigger picture. It remains a close call as to whether it will pull the rate-cutting trigger again at the conclusion of the November 5-6 confab. For sure, another jumbo half-point reduction that was put through at its previous meeting in mid-September, will not take place. At that meeting, officials expected to lower rates by another 50- basis points this year, implying quarter-point reductions both in November and December. However, thanks to the recent upside surprises in some key economic data investors have dialed back rate-cutting prospects, with many arguing for the Fed to skip any move until December.

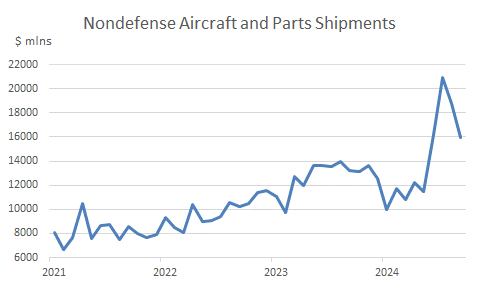

By then, of course, the hurricane season will be over and, hopefully, so too will the Boeing strike, which is being extended by the rejection of union members of the companys latest proposal. We received clear evidence of the strikes impact on aircraft shipments in September, which fell dramatically for the second consecutive month. These shipments feed into the calculation of business equipment spending in the GDP accounts, so they will be a modest drag on such spending when the third-quarter GDP report is released next week. Whats more, a further drag from the plane maker will be evident in November as well, as the strike shut down production of the 737 Max and other models. Even when the strike does end, it will take time for Boeing to ramp up production due to challenges facing its largest supplier, among other issues.

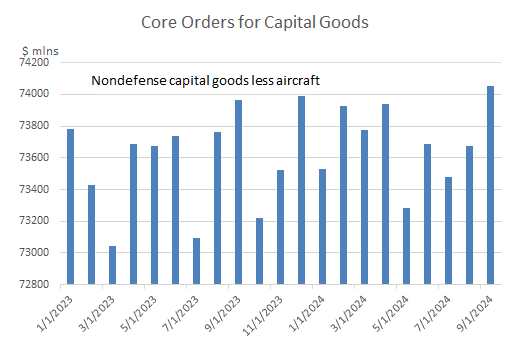

Another reason to expect a weaker performance for equipment spending in the fourth quarter is policy uncertainty around the election, which puts a ceiling on the near-term trajectory for equipment outlays. Polls suggest that the election will come down to the wire, further accentuating the uncertainty around future policymaking, given the daylight that exists between the economic platforms of the two leading presidential candidates. According to the Richmond Fed, election-related uncertainty has prompted a fifth of surveyed firms to postpone their investment plans. That said, aircraft spending tends to be lumpy from month to month, and economists prefer to look at nondefense capital goods orders excluding aircraft to get a clearer signal of business investment spending over the balance of the year.

Here, the near-term outlook looks much brighter. Orders for core capital goods increased 0.5 percent in September, an acceleration from the 0.3 percent increase in August. That marks the first back-to-back increase this year, led by a sturdy 2.1 percent increase in orders for fabricated metals. This segment of durable goods is benefiting from federal policies such as the CHIPS Act and the Bipartisan Infrastructure Law that is boosting nonresidential construction spending.

We expect the economy to benefit from continued strength in business investment spending next year. The primary driver will be the Federal Reserve continuing to cut interest rates, with quarter-point reductions expected once per quarter in 2025. This will provide interest-rate relief to businesses, which typically borrow to purchase durable goods. Big-ticket spending by consumers will also benefit from lower rates, with positive downstream effects on durable goods orders.

Besides lower interest rates, there are other key factors underpinning our sanguine forecast for equipment spending. Business spending on Artificial Intelligence technologies will continue to support growth in information processing equipment. The past boom in manufacturing structures will also increasingly bleed into equipment orders as these factories become operational. Businesses remain focused on enhancing productivity and will invest in labor-saving technologies that automate routine manual tasks.

That said, the main growth driver next year, as always, will be consumers. As last weeks discussion of retail sales indicates, households kept cash registers at retailers ringing in September. Those purchases were mainly for goods; we will be getting more complete information on consumer purchases, including from service providers, next week along with the third-quarter GDP and all-important jobs report for October. We expect households to keep spending at a solid pace going forward unless the job market tanks, which is not expected. Not only are most household balance sheets in good shape, incomes are growing and outpacing inflation.

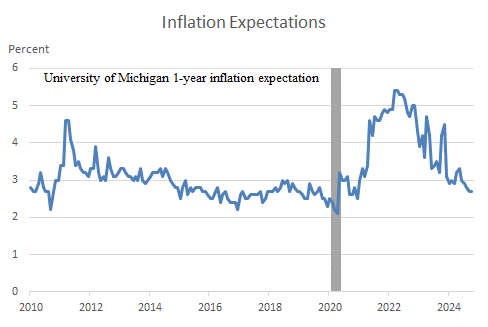

Importantly, consumer sentiment is slowly emerging from the dumps, as the University of Michigan Sentiment index increased for the second consecutive month in October. However, the Michigan household survey has a heavy political component.Respondents generally consider who they expect the next president to be when completing the survey, and a decline in the share expecting Vice President Harris to win the election resulted in worse sentiment among Democrats and improved sentiment amongst Republicans. Sentiment rose 4% in October among Independent responders which likely offers a bit more clarity on the true movement of sentiment without political bias.

However, there are compelling economic reasons for a more upbeat sentiment among households. The Feds rate cuts, making borrowing cheaper, is clearly one positive influence. Another and this might be key in the upcoming election is the improved expectations regarding inflation particularly over the next year. At 2.7 percent in October, the expected inflation rate is back to where it was prior to the pandemic, which echoes the marked slowdown in actual inflation over the past year.The question is, of course, whether voters will be influenced more by the current change in prices (the inflation rate) versus the cumulative change since the pandemic when the Biden administration took office (i.e. the level of prices).