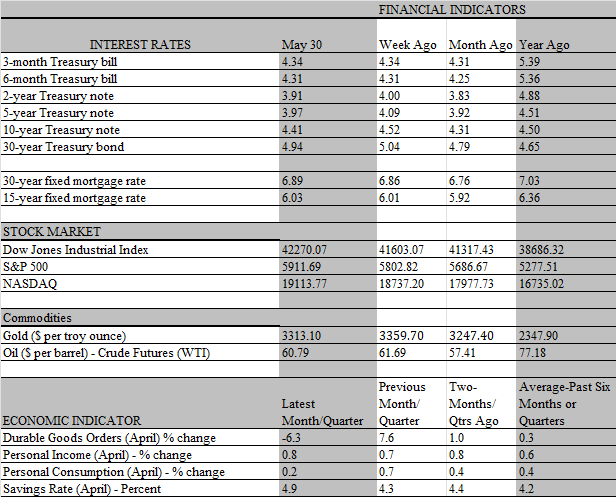

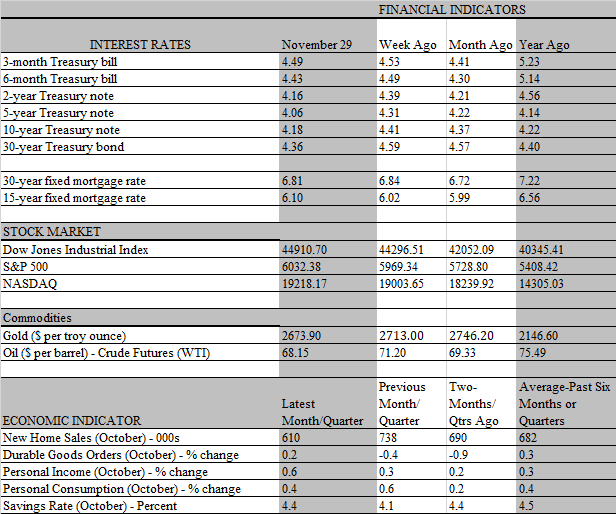

That�s also the strategy embraced by the Federal Reserve, as confirmed by Chair Powell recent assertion that it is too early to include speculative tariff prospects in its policy decisions. As it is, there are more than enough imponderables among the usual suspects for the Fed to consider. High on the list is the question of whether inflation is cooling fast enough to pull the rate cutting trigger again at its upcoming meeting on December 17-18. The markets are pricing in a 66 percent probability that another quarter-point reduction will take place at that gathering. But recent comments by several officials along with this weeks release of the FOMC minutes from the November meeting suggest that there is meaningful support within the Fed to stay on the sidelines until more data becomes available.

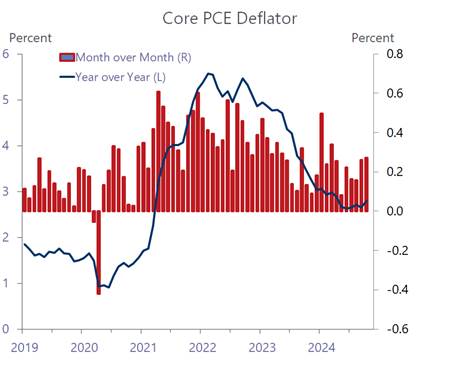

While we agree the Fed will probably lower the fed funds rate by a quarter point at its mid-December meeting, the case for patience is highly understandable. For one, inflation is not receding as quickly as the Fed would like, based on the quarterly summary of economic projections unveiled at the September meeting. Then, the expectation was that the annual increase in the core personal consumption deflator — the Feds preferred inflation yardstick would end the year at 2.6 percent. But that measure is trending in the opposite direction, increasing 2.8 percent from a year-earlier in October, up from a 2.7 percent pace in September, according to the monthly personal income and spending report released this week. Thats not an alarming increase, but the base effects are not favorable for a turnaround as the data for November and December will be compared to low year-earlier inflation rates.

Unless this broad swath of service prices reverts to a declining trend, the path to the Feds 2 percent target will become ever-more challenging. Since these prices are heavily influenced by labor costs, any turnaround would depend on a further softening in the job market, something that Fed chair Powell has already indicated would not be a welcome development. That dilemma facing policymakers is what makes the odds of a rate cut in December so volatile. Not only do trader bets on a Fed move shift with each economic indicator that defies expectations, the onslaught of disruptive external forces in recent months has undermined the reliability of the very indicators the Fed relies on to make decisions. The impact of two major hurricanes and strikes at Boeing and Stellantis has injected a good deal of guesswork into analyzing recent reports on jobs, housing activity and production.

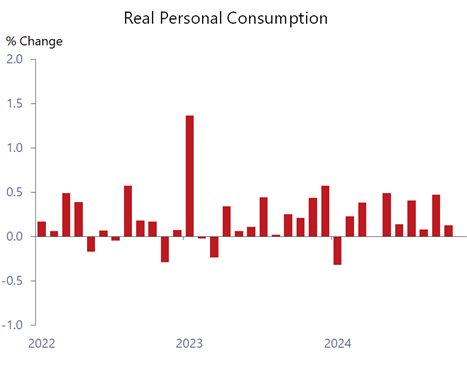

And while Trumps tariff proposals add to the potential guesswork, there is anecdotal evidence that they are already affecting the behavior of businesses and households. Several companies announced plans to step up orders from abroad before tariffs go on the books, and there is a nascent media blitz underway urging consumers to buy now before prices go up. Over the near term, this activity poses upside risks to the economys growth rate and, by extension, inflation. Whats more, the notion that there is little urgency for the Fed to cut rates amid a still strong economy is supported by most incoming data. Notably, the economys main growth driver, consumers, shows no sign of zipping up their wallets or purse strings.

Along with the stubborn inflation data in October, the monthly report on personal income and spending indicates that households still have formidable purchasing power and are not reluctant to use it. Higher prices did account for most of the spending increase last month, but the slim 0.1 percent increase in real outlays came on the heels of an outsized 0.5 percent gain in September. Hence, the fourth quarter started on an elevated plane, which will impart heft to the periods growth rate. And, while spending slowed from September, personal income jumped, both in current dollars and adjusted for inflation and taxes. Real disposable incomes last month staged the largest increase since January, providing more of a savings cushion for future spending.

Still, while the latest data provides ammunition for the Fed to stay on the sidelines, the case for a rate cut at its mid-December meeting should not be downplayed. Fed officials readily admit that current rates are restrictive even after two reductions, and the need to guard against a lagged impact that could send the economy into a tailspin remains compelling. A preemptive easing for survival insurance should not inflame the inflation embers amid softening labor market conditions and price-sensitive consumers who have lowered inflation expectations. At the same time, uncertainty over tariffs and fiscal policy could be a drag on growth heading into the new year. While companies may be frontloading their order books in advance of tariffs, some are also putting off investment plans for the same reason. Whether or not the Fed cuts rates at its upcoming meeting, all eyes will be focused on the new set of economic projections that will come out of the meeting and how Powell assesses the myriad crosscurrents in his post-meeting press conference.