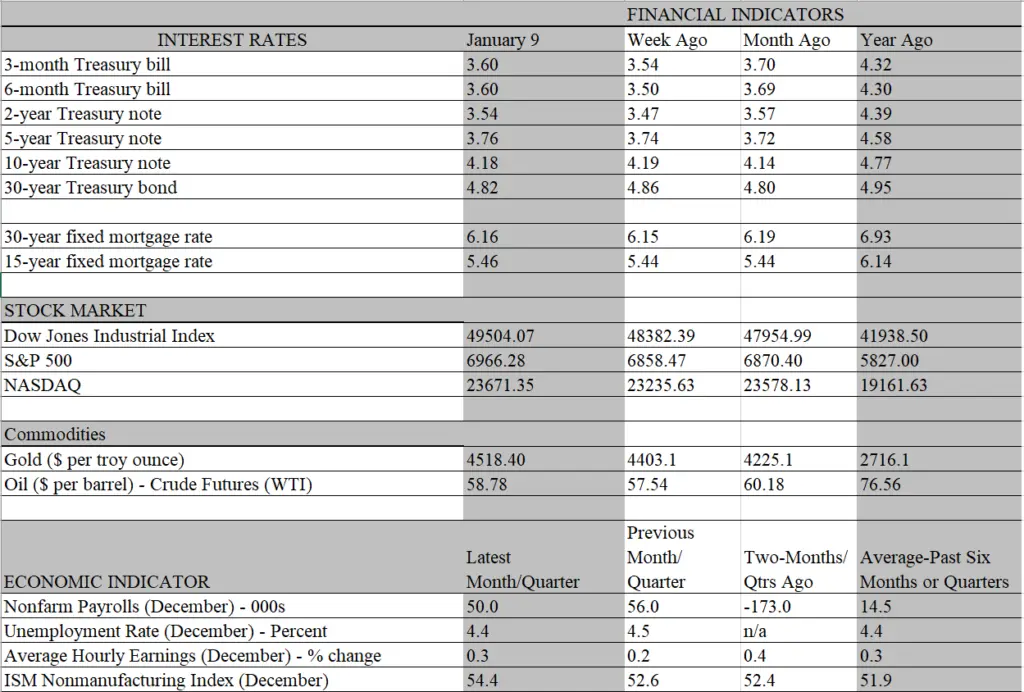

With the jobs report for December now on the books, it’s time to say a not-so-fondly goodbye to 2025. To be sure, the data are preliminary and subject to revision, and a bevy of other reports capturing year-end activity is yet to come. But jobs are the main engine of growth, and its trend provides a best sense of how the economy is performing. The bottom line: the year just completed deserves faint applause, given the barrage of obstacles it had to overcome. But hold the champagne, because the last scene is not worthy of great reviews, although it provided enough drama to satisfy the critics and fans.

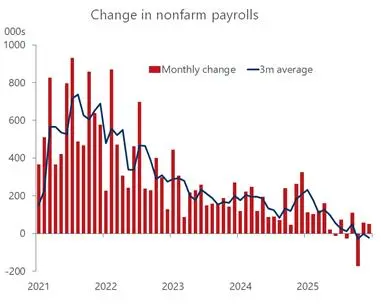

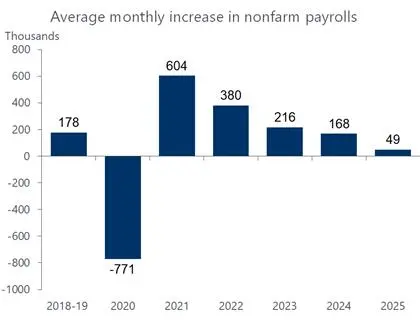

On the positive side, private companies added jobs in every month of the quarter, a respectable showing given the noise surrounding the government shutdown, heightened uncertainty regarding monetary policy and lingering anxiety over the lagged inflationary impact of tariffs. On the negative side, it was the weakest quarter for private-sector job growth not only for the year but going back to the pandemic recession. The landscape looks even darker when government workers are thrown into the mix. Indeed, the government shutdown and DOGE cutbacks played havoc with the overall picture, resulting in an outright decline in payrolls for the fourth quarter, as 179 thousand federal workers fell off the books in October. Happily, the Federal drag on payrolls is now in the rear-view mirror, as the government actually added some jobs in November and December. Still the 50 thousand increase in total nonfarm payrolls last month was modestly weaker than the consensus expectations of around 70 thousand.

The fourth quarter slowdown in job growth punctuates a year-long trend that featured a far-weaker increase in payrolls than seen prior to the pandemic. Ordinarily, that trend would make the Fed trigger-happy, poised to cut rates aggressively to stave off a recession. However, job growth in the range of 50 thousand a month is now the new normal, given the slimmed down pool of labor deprived of aging workers heading for retirement as well as the exodus of foreign-born workers hastened by the administration’s immigration crackdown. With fewer people seeking jobs, less hiring is needed to prevent the unemployment rate from rising. In December, a modest 46 thousand decline in the labor force helped lower the unemployment rate to 4.4 percent from a downwardly revised 4.5 percent in November. If anything, the near-term stability of this rate should keep the Fed on the sidelines, perhaps until a new chairman takes over the helm in May.

It is hard to see anything drastic happening before then that would bring the Fed off the sidelines. The conflicting influences that are generating an unusual split of opinions among officials remain very much in place. The doves continue to fret over the negative portents linked to the low hiring/low firing narrative. While that’s keeping the unemployment rate from rising, it is also keeping job seekers from finding work. In December, the share of unemployed workers for more than six months rose to 26 percent, the highest since February 2022 and up from 24.4 percent in November. That share may come under further pressure in the months ahead, as job vacancies are dwindling, falling below the number of job searchers. For every 100 unemployed workers there were 91 job openings at the end of November, the lowest ratio outside of the pandemic since 2017. The competition for jobs is set to become more intense, as exiled government workers exhaust their severance paychecks and decide to return to the workforce. Those reentrants could also impart a temporary bump in the unemployment rate.

Whether that sways more policy makers to the dovish side depends on how it translates into real activity. Most important is how the conflicting labor market trends play out at the cash registers. The key influence behind last year’s resilience in consumer spending came from the outsized support of upper-income households who enjoyed another year of burgeoning net worth from appreciating financial assets. The sustainability of this positive wealth effect is not assured, as it could readily be undercut by a harsh market setback. Hence, much will depend on whether real incomes, which is the bedrock of support for lower and middle-income households, can take the mantle of growth from wealthier households should the need arise.

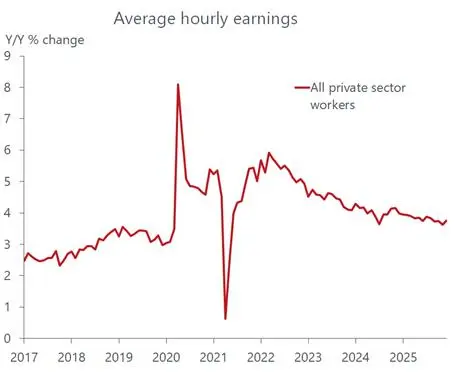

In this regard, the more hawkish Fed officials can find some solace in the latest jobs report. Simply put, the fortunate segment of the population holding jobs are seeing their paychecks keeping up with inflation. In December, average hourly earnings stood 3.8 percent higher than a year ago, more than outpacing inflation of just under 3 percent. The earnings increase last month squelched concerns over the sharp drop to 3.5 percent that occurred in the previous month. Not only did the December rebound stifle fears over a potential wage meltdown, but the November increase was also revised up to 3.6 percent.

Importantly, it’s not likely that the solid earnings increase is being skewed higher by a change in the composition of job growth, with high-paying workers taking a greater share of the payroll increases. Over the past five months, workers in leisure and hospitality have accounted for 70 percent of job growth. That’s an outsized contribution from a sector that only accounts for about 10 percent of total employment. Meanwhile, these workers earn an average of $23.28/hr. compared to an average of $37.02/hr. for all private workers. The other main driver of job growth – health and social services – accounted for an even larger share of private payroll increases, 122 percent, over the past five months and its workforce earned $35.91/hr. – better than those in leisure and hospitality but still under the overall average. If you do the math, notice that omitting these two sectors from nonfarm employment would result in a drop in payrolls over this period. If anything, the impact from the changing composition of job growth over the past five months should be down, not up.

The good news is that wages in these lower paying occupations have been rising faster than for all private sector workers over the past three months, and these jobs have a relatively high concentration of minimum-wage workers who will be receiving a legislated bump in pay in many states starting this month. Hence, the prospect that real disposable incomes will advance at a decent pace this year is favorable, broadening the consumption base and possibly cushioning a weaker wealth effect from affluent households should the markets sputter. The bad news for policy doves is that labor costs could keep the glue in sticky inflation, delaying a Fed rate cut that might come too late to support a weakening job market.

From our lens, that is far from a serious threat. The economy will be receiving considerable thrust early in the year from fiscal stimulus, thanks to the tax relief accruing to households and businesses from the One Big Beautiful Bill Act, fading uncertainty regarding tariffs and the wealth buffer still intact from past asset gains. What’s more, a 3.7 percent increase in wages is fully compatible with the Fed’s 2 percent inflation target, as productivity growth is offsetting about 2 percent of the increase. Keep in mind too that base effects will turn favorable for inflation over the second half of the year, as prices will be measured against a tariff-enhanced base during the last half of 2025. Amid decent growth and fading inflation, we still expect the Fed to cut rates twice this year, albeit the first move is probably a few months away.