The first quarter of 2025 was the worst quarter for stocks in 3 years. Why?

The new administration promised less regulations, investor friendly merger approvals, lower inflation, and a stronger economy – all usually good for stock prices. We have not seen any of that yet. We have seen lower interest rates, but for the wrong reason. Investors now expect the economy to slow, and corporate earnings to languish so they are buying bonds, pushing down bond yields. Since January, the 10 year Treasury bond yield has fallen from 4.8% to 4.15%, a huge drop in such a short period of time.

Investors hate uncertainty and the proposed tariffs are creating that. As we go to press the degree, length and effect of increased tariffs (taxes) on imported goods is unknown. What is known is that consumer prices will probably rise. That could cause the Federal Reserve to pause their plan to gradually lower interest rates, which investors had been expecting. When citizens are worried about their economic future, they cut back their spending. We are starting to see that now. Consumer spending powers our economy and less of that affects corporate profits, which is the pillar of stock valuations.

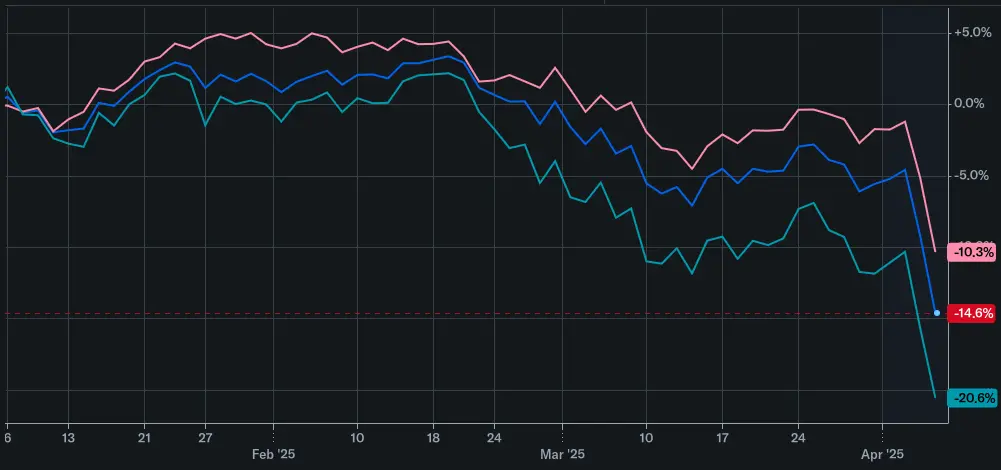

What is next for the stock market? We have had a 10% retracement from the record highs set in January. Many stocks are down much more than that. Investor sentiment is at record lows. Typically, that happens at market lows so while the market may stagnate for a while we see higher prices later this year, assuming interest rates do not rise, and corporate profits continue to grow, albeit more slowly.

Some stocks we like at current prices span many sectors of the market. They include: Alphabet (GOOGL) $155, Verizon, $45, Johnson & Johnson, $158, Truist Financial $40.50, First Solar, $123.25, Pfizer, $ 25. Contact any of our friendly advisors for more information about the above or for a free portfolio check-up.